Stay Ahead in Fast-Growing Economies.

Browse Reports NowMoney Transfer App Market Emerging Trends, Challenges & Strategic Forecast (2024-2032)

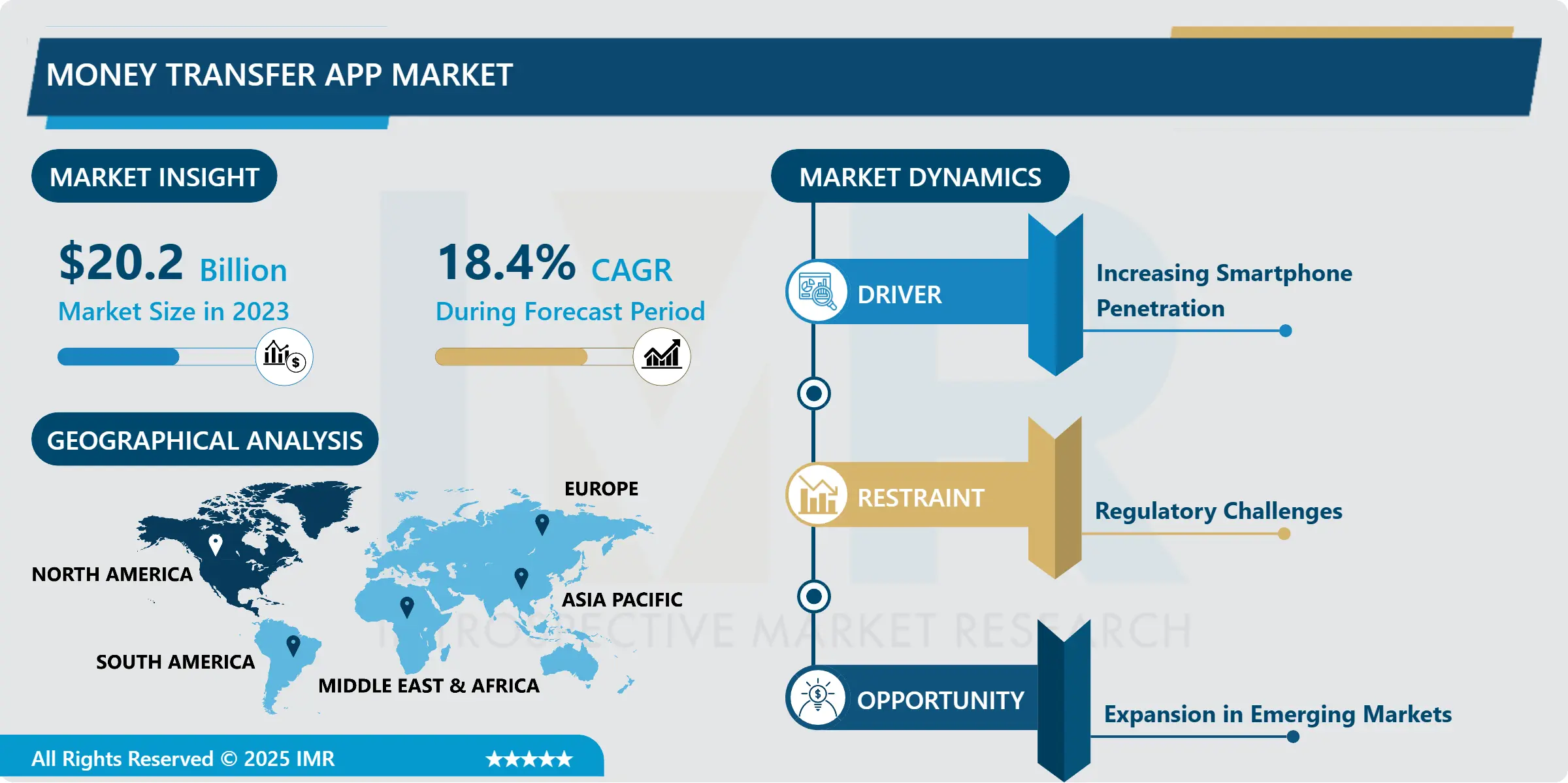

Money Transfer App Market Size Was Valued at USD 20.2 Billion in 2023, and is Projected to Reach USD 92.2 Billion by 2032, Growing at a CAGR of 18.4% From 2024-2032.

IMR Group

Description

Money Transfer App Market Synopsis:

Money Transfer App Market Size Was Valued at USD 20.2 Billion in 2023, and is Projected to Reach USD 92.2 Billion by 2032, Growing at a CAGR of 18.4% From 2024-2032.

The Money Transfer App Market is defined as the industry where people and companies use mobile applications to transfer funds from one geographical location to another. These apps give a simpler, faster, and secured method of transfer through smart phones hence easing transactions and expanding financial services.

The Money Transfer App Market has experienced a massive growth in recent years because of Smartphones adoption, E-commerce, and the need for Fast and Cheap Methods of remitting money Cross-boarder. Money transfer applications allow customers to transfer money within the same country or the other without many charges, it speeds up the process, convenience and widely-covered area. These apps are gradually becoming common in both the developed and the developing economies based on the increasing funding systems compounded by the ever-growing number of smart phone users.

Technological change especially innovation in mobile devices, have further helped in the increase the uptake of the digital wallets and P2P transfer services. Entities such as PayPal, Venmo, Western Union among a list that have aligned their services to the dynamic market needs of the consumer and the business. With checks, money transfers continue to go through the electronic money transfer instead of going through a checkbook, thus more people using their mobilephones to transfer money. This tendency is even more obvious in areas where, on the one hand, mobile phone adoption is relatively high; on the other hand, the availability of such ‘legacy’ banking tools such as branches, ATMs, and other brick-and-mortar facilities is low.

Money Transfer App Market Trend Analysis:

Integration with Cryptocurrencies

One emerging trend visible in the Money Transfer App Market is a combination of cryptocurrencies and mobile money transfer services. With more traditional and younger consumers adopting cryptocurrency as a legitimate type of digital currency, many payment applications are extentsively providing an opportunity to send and receive payments in Bitcoin, Ethereum, and other types of cryptocurrencies. The above trend allows users to overcome the limitations of banking systems, make faster transfers between countries, and, unlike money transfers in conventional currencies, it has lower fees.

Integration shows DeFi as the new trend for BFS that reduce the settlement time and provide broader access to the global market. Cryptocurrencies also have enhanced privacy and lesser dependency on middlemen making it a preference to users who like to have their identity concealed. Cross-border payments through apps based on crypto-currencies may represent an opportunity to redesign the future of remittances for individual and corporate clients.

Expansion in Emerging Markets

It will be quite rewarding to move full services to the Money Transfer App Market to evolving markets, in which formal banking is scarce. Population growth, especially in the developing world, specifically Africa, Southeast Asia, and Latin America, has a vast population which is still unserved by formal banking systems this offers the avenue that can be filled by mobile money transfer applications. Thus, these applications can ensure financial inclusions and contribute to the development of the economies in regions where people still have not enough opportunities to obtain regular financial services.

Smartphone usage in emerging markets has been equally fast and this must be seen as a great chance to expand the market for money transfer application. Any company that can deliver to these markets solutions, for example low transaction costs, support for local currency and integration with local payment methods is likely to capture a major slice of this virtually untapped market. Furthermore, mobile network providers can strengthen these applications and make them more easily accessible in areas with limited accessibility.

Money Transfer App Market Segment Analysis:

Money Transfer App Market is Segmented on the basis of Type of Service, Platform, Transaction Method, End User, and Region.

By Type of Service, Domestic Transfers segment is expected to dominate the market during the forecast period

The Money Transfer App Market can be broadly segmented into Domestic Transfer and International Transfers. Domestic transfers include taking money within a country and are a service to people and companies who require to transfer money within their country. These services are mostly applied for paying bills, transferring money to friends, and using in business with small turnover. They usually have quicker than transfer time and fees charges than the international transfers. What is more, the recent growth of mobile payment, made people prefers the domestic transfers as for every day usage, hence, stimulating the growth.

Cross-border transactions, on the other hand, include transfer of money to another country and are widely used for money transfer, payment for business, and online customers international transactions. These transfers sometimes include conversion and have usually higher charges, however have a vast potential profit for money transfer apps serving the huge volume of undervalued migrant and expatriate population globally. There is a greater focus towards globalisation through outsourcing, export. Importation and travel being some of the factors that will contribute to the growth of international money transfer services market in the future..

By End User, Individual segment expected to held the largest share

On the basis of the end user, the Money Transfer App Market is also classified into two types namely Individual and Business. Small users exercise these applications for individually related purposes, including remittances, purchasing products and services, and P2P transfers. Retail is the largest segment traditionally fueled by inherent need of people to achieve convenient and inexpensive fund transfer services. The fact that everyone can use the mobile apps and get any information they need in several minutes is one of the benefits of using such an application.

On the other hand, Business users use money transfer apps for business oriented actions, for example, paying contracts to other businesses or receiving payments for products they offer, or paying their employees’ wages. One major reason why digital transfer solutions are chosen above others by businesses include ease of use, security and speed in transferring large sums of money across borders. Since trading is expanding at the international level and e-business is being popularized, it is anticipated that the need for money transfer services for commercial purposes will remain important, which makes business an important category in the total market.

Money Transfer App Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

Among the regional segments in the money transfer app market, North America is presently the market leader, mainly because of the increased usage of smartphones, well-developed financial systems, and fast-growing use of mobile payments. PayPal, Venmo, and now Zelle make North America a confirmed market leader due to the already existing players in the market. Besides that, the fact that the region boasts of a well-developed financial services industry especially in mobile communication and a good enabling legal framework are some factors that have informed why mobile money transfer app companies have established themselves in the region.

North America also has a large migrant population through people who use international money transfers. The ability to move money across borders within the region meeting low cost of transactions and fast turn around time has given fillip to money transfer apps. Due to the continually increasing trend in digital payment sector, North America is anticipated to dominate the world market with the help of mobile technology and financial services in future.

Active Key Players in the Money Transfer App Market:

PayPal (USA)

Western Union (USA)

Venmo (USA)

MoneyGram (USA)

TransferWise (Wise) (UK)

Remitly (USA)

Revolut (UK)

Xoom (USA)

WorldRemit (UK)

Skrill (UK)

Azimo (UK)

Alipay (China), and Other Active Players

Key Industry Developments in the Money Transfer App Market:

In January 2024, ICICI Bank Canada, a wholly-owned subsidiary of ICICI Bank Limited, announced the launch of its mobile banking app called ‘Money2India (Canada). ‘This new app allows customers of any bank in Canada to instantly and conveniently transfer funds 24/7 to any bank account in India, without the need to open an account with ICICI Bank Canada.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Money Transfer App Market by Type of Service

4.1 Money Transfer App Market Snapshot and Growth Engine

4.2 Money Transfer App Market Overview

4.3 Domestic Transfers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Domestic Transfers: Geographic Segmentation Analysis

4.4 International Transfers

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 International Transfers: Geographic Segmentation Analysis

Chapter 5: Money Transfer App Market by Platform

5.1 Money Transfer App Market Snapshot and Growth Engine

5.2 Money Transfer App Market Overview

5.3 Android

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Android: Geographic Segmentation Analysis

5.4 iOS

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 iOS: Geographic Segmentation Analysis

5.5 Web-based

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Web-based: Geographic Segmentation Analysis

Chapter 6: Money Transfer App Market by End-user

6.1 Money Transfer App Market Snapshot and Growth Engine

6.2 Money Transfer App Market Overview

6.3 Individual

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Individual: Geographic Segmentation Analysis

6.4 Business

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Business: Geographic Segmentation Analysis

Chapter 7: Money Transfer App Market by Transaction Method

7.1 Money Transfer App Market Snapshot and Growth Engine

7.2 Money Transfer App Market Overview

7.3 Bank-to-Bank Transfers

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Bank-to-Bank Transfers: Geographic Segmentation Analysis

7.4 Mobile Wallets

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Mobile Wallets: Geographic Segmentation Analysis

7.5 Cash Pickup

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Cash Pickup: Geographic Segmentation Analysis

7.6 Credit/Debit Card Payments

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Credit/Debit Card Payments: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Money Transfer App Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 PAYPAL (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 WESTERN UNION (USA)

8.4 VENMO (USA)

8.5 MONEYGRAM (USA)

8.6 TRANSFERWISE (WISE) (UK)

8.7 REMITLY (USA)

8.8 REVOLUT (UK)

8.9 XOOM (USA)

8.10 WORLDREMIT (UK)

8.11 SKRILL (UK)

8.12 AZIMO (UK)

8.13 ALIPAY (CHINA)

8.14 OTHER ACTIVE PLAYERS

Chapter 9: Global Money Transfer App Market By Region

9.1 Overview

9.2. North America Money Transfer App Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Type of Service

9.2.4.1 Domestic Transfers

9.2.4.2 International Transfers

9.2.5 Historic and Forecasted Market Size By Platform

9.2.5.1 Android

9.2.5.2 iOS

9.2.5.3 Web-based

9.2.6 Historic and Forecasted Market Size By End-user

9.2.6.1 Individual

9.2.6.2 Business

9.2.7 Historic and Forecasted Market Size By Transaction Method

9.2.7.1 Bank-to-Bank Transfers

9.2.7.2 Mobile Wallets

9.2.7.3 Cash Pickup

9.2.7.4 Credit/Debit Card Payments

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Money Transfer App Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Type of Service

9.3.4.1 Domestic Transfers

9.3.4.2 International Transfers

9.3.5 Historic and Forecasted Market Size By Platform

9.3.5.1 Android

9.3.5.2 iOS

9.3.5.3 Web-based

9.3.6 Historic and Forecasted Market Size By End-user

9.3.6.1 Individual

9.3.6.2 Business

9.3.7 Historic and Forecasted Market Size By Transaction Method

9.3.7.1 Bank-to-Bank Transfers

9.3.7.2 Mobile Wallets

9.3.7.3 Cash Pickup

9.3.7.4 Credit/Debit Card Payments

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Money Transfer App Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Type of Service

9.4.4.1 Domestic Transfers

9.4.4.2 International Transfers

9.4.5 Historic and Forecasted Market Size By Platform

9.4.5.1 Android

9.4.5.2 iOS

9.4.5.3 Web-based

9.4.6 Historic and Forecasted Market Size By End-user

9.4.6.1 Individual

9.4.6.2 Business

9.4.7 Historic and Forecasted Market Size By Transaction Method

9.4.7.1 Bank-to-Bank Transfers

9.4.7.2 Mobile Wallets

9.4.7.3 Cash Pickup

9.4.7.4 Credit/Debit Card Payments

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Money Transfer App Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Type of Service

9.5.4.1 Domestic Transfers

9.5.4.2 International Transfers

9.5.5 Historic and Forecasted Market Size By Platform

9.5.5.1 Android

9.5.5.2 iOS

9.5.5.3 Web-based

9.5.6 Historic and Forecasted Market Size By End-user

9.5.6.1 Individual

9.5.6.2 Business

9.5.7 Historic and Forecasted Market Size By Transaction Method

9.5.7.1 Bank-to-Bank Transfers

9.5.7.2 Mobile Wallets

9.5.7.3 Cash Pickup

9.5.7.4 Credit/Debit Card Payments

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Money Transfer App Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Type of Service

9.6.4.1 Domestic Transfers

9.6.4.2 International Transfers

9.6.5 Historic and Forecasted Market Size By Platform

9.6.5.1 Android

9.6.5.2 iOS

9.6.5.3 Web-based

9.6.6 Historic and Forecasted Market Size By End-user

9.6.6.1 Individual

9.6.6.2 Business

9.6.7 Historic and Forecasted Market Size By Transaction Method

9.6.7.1 Bank-to-Bank Transfers

9.6.7.2 Mobile Wallets

9.6.7.3 Cash Pickup

9.6.7.4 Credit/Debit Card Payments

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Money Transfer App Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Type of Service

9.7.4.1 Domestic Transfers

9.7.4.2 International Transfers

9.7.5 Historic and Forecasted Market Size By Platform

9.7.5.1 Android

9.7.5.2 iOS

9.7.5.3 Web-based

9.7.6 Historic and Forecasted Market Size By End-user

9.7.6.1 Individual

9.7.6.2 Business

9.7.7 Historic and Forecasted Market Size By Transaction Method

9.7.7.1 Bank-to-Bank Transfers

9.7.7.2 Mobile Wallets

9.7.7.3 Cash Pickup

9.7.7.4 Credit/Debit Card Payments

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Money Transfer App Market research report?

A1: The forecast period in the Money Transfer App Market research report is 2024-2032.

Q2: Who are the key players in the Money Transfer App Market?

A2: PayPal (USA), Western Union (USA), Venmo (USA), MoneyGram (USA), TransferWise (Wise) (UK), Remitly (USA), Revolut (UK), Xoom (USA), WorldRemit (UK), Skrill (UK), Azimo (UK), Alipay (China), and Other Active Players.

Q3: What are the segments of the Money Transfer App Market?

A3: The Money Transfer App Market is segmented into Type, Platform, Transection Method, End User and Region. By Type of Service, the market is categorized into Domestic Transfers, International Transfers. By Platform, the market is categorized into Android, iOS, Web-based. By End-user, the market is categorized into Individual, Business. By Transaction Method, the market is categorized into Bank-to-Bank Transfers, Mobile Wallets, Cash Pickup, Credit/Debit Card Payments. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Money Transfer App Market?

A4: The Money Transfer App Market is defined as the industry where people and companies use mobile applications to transfer funds from one geographical location to another. These apps give a simpler, faster, and secured method of transfer through smart phones hence easing transactions and expanding financial services.

Q5: How big is the Money Transfer App Market?

A5: Money Transfer App Market Size Was Valued at USD 20.2 Billion in 2023, and is Projected to Reach USD 92.2 Billion by 2032, Growing at a CAGR of 18.4% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!