Stay Ahead in Fast-Growing Economies.

Browse Reports NowGenetic Testing Market – Latest Advancement & Future Trends (2024-2032)

The genetic testing market is the business dealing with the utilization of genetic tests to determine a specific change or mutation in an individual’s DNA that may cause inherited illnesses or disorders, risks of contracting a particular ailment, or chance of passing on inherited characteristics to offspring. Such tests are mostly applied in diagnostics, as well as for the treatment, genetic tracing and reproductive health. In other cases, genetic testing is performed through polymerase chain reaction PCR, next-generation sequencing NGS, microarray analysis, others.

IMR Group

Description

Genetic Testing Market Synopsis:

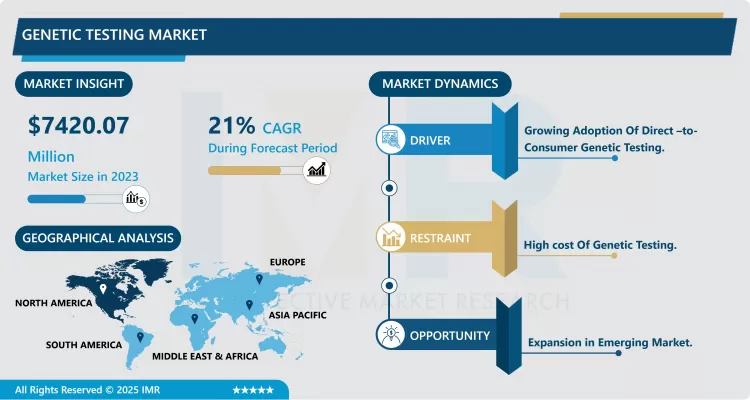

Genetic Testing Market Size Was Valued at USD 7,420.07 Million in 2023, and is Projected to Reach USD 41254.98 Million by 2032, Growing at a CAGR of 21.0% From 2024-2032.

The genetic testing market is the business dealing with the utilization of genetic tests to determine a specific change or mutation in an individual’s DNA that may cause inherited illnesses or disorders, risks of contracting a particular ailment, or chance of passing on inherited characteristics to offspring. Such tests are mostly applied in diagnostics, as well as for the treatment, genetic tracing and reproductive health. In other cases, genetic testing is performed through polymerase chain reaction PCR, next-generation sequencing NGS, microarray analysis, others.

The global genetic testing market has been continually growing in the last few years due to the innovation improvements in genetic engineering, increase in genetic sequencing costs, and awareness levels regarding genetic disorders and individualized health care. The market is segregated based on its applications such as diagnostics, drug discovery, ancestry and carrier screening. The increasing need for precision medicine, also known as personalized medicine that develops treatments and medicines based on the patient biology is the key driver of the market. In the same manner there is an increasing use of molecular diagnostic techniques or, otherwise, genetic tests to identify early disease signs and specific treatment strategies in order to improve the patients’ quality of life on par with the state of the art.

Raising levels of expenditure on R and D by both private individuals, firms and public health agencies are facilitating improvements in the technology utilized in genetic tests. Moreover, the analysis has found that regulation approval is playing a big role in the promotion of genetic testing, particularly in North America and Europe. Another major factor that is fast contributing to the expansion of this market is the increased health consciousness of the people and the ready availability of direct access genetic tests. Nevertheless, there are some issues, which can act as barriers to its rapid introduction in certain places: data protection issues, a high cost, and insufficient availability of genetic counseling.

Genetic Testing Market Trend Analysis:

Growing Adoption of Direct-to-Consumer Genetic Testing

Therefore, one of the most apparent trends observed in the genetic testing market is the growing DTC genetic testing services. These services allow the customers to get the genetic testing kits they need to perform genetic tests independently of a doctor’s recommendation, providing information about ancestry, probabilities of developing certain diseases or conditions, or possessing some genes that may be beneficial for the person in question, all without leaving their homes. Businesses such as 23andMe and Ancestry.com, as well as its competitor MyHeritage site, have skyrocketed over several years because of their user-friendly interface and attractive advertisements. DTC testing helps consumers to begin taking charge of their own health since some tests also inform the consumers about their likely gene type to diseases such as diabetes, Alzheimer’s and cancer. This trend is lowering the costs of genetic testing, lifting the barriers towards penetration into different segments and creating higher levels of adoption across all the market segments.

This rise is also being driven by increased knowledge and concern towards preventative health. Customers are aspiring for how to know the type of gene they have inherited and how to modify their lifestyle in order keep minimum health risks. Nonetheless, there are certain privacy problems regarding DTC genetic testing; however, the demand increases because of the society’s acceptance of the technology.

Expansion in Emerging Markets

Another promising trend affecting the genetic testing market is the issue of gaining a greater market share by exposing new geographical areas, especially Asia-Pacific, Latin America, parts of Africa. It is a fact that these regions are experiencing a fast expansion of health care investments, rising per capita income, and enhanced health care facilities. With increasing awareness of genetic testing these regions present a clear opportunity for businesses to open up to provide affordable genetic testing services. Further, elevated incidence of chronic illnesses including diabetes and cardiovascular illnesses, some of which have genetic influences open the flood gates for genetic testing in early detection and prevention.

Moreover, the increased focus of the governments towards the development of new healthcare facilities and technology required for conducting genetic testing in the emerging markets help the growth of the genetic testing market. These regions are also aspiring to adopt telemedicine, which may also be an addition to the use of genetic tests for a telemedicine consultation. To firms seeking international markets, deploying themselves in such markets therefore symbolizes a vast prospect for growth in the next couple of years.

Genetic Testing Market Segment Analysis:

Genetic Testing Market is Segmented on the basis of technology, application ,Product ,Channel, end user, and region

By Technology, Next Generation Sequencing segment is expected to dominate the market during the forecast period

The next-generation sequencing segment occupies a high growth rate of 23.03% in the period of 2023 to 2030. Growth is expected due to rising genome mapping programs, raised healthcare cost, technological improvement, and a higher number of applications of next-generation sequencing. Molecular diagnostics are being used with enhanced frequency for identification and different characterization of cancer and multiple genomic disorders. Cancer genetic testing or profiling with applying tumor DNA sequencing defines different genetic changes. It also aids in the underlying analysis of what particular treatments are most effective in reference to the identified or discovered genetic alteration. Hence, cancer and inherited diseases are great reasons for wanting more of genetic testing within clinical and research contexts.

By Application, Ancestry & Ethnicity segment expected to held the largest share

Genetic testing can help regarding future risk of the disease and provides information and data regarding a child’s genome. However, testing is useful for those with ancestry of disorders. However, threats like the equipment cost for genomic research, coupled with the intricacy involved in commercial genomics and consumer and wellness genomics could slow down the growth of genetic testing industry in the forecast period. It explored the health and wellness-predisposition/risk/tendency segment as the largest and most dominant share of 47.64% of the global market in 2022. Hence, is expected to continue to dominate with the faster growth rate in the forecast period. Predictive genetics and consumer/wellness genomics are very popular especially due to ongoing development of healthy lifestyle and information campaigns in the field of health care.

Genetic Testing Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

Thus, in 2023, North America and especially the United States remains the largest market, holding the major share of it due to increased healthcare expenditure and awareness about the availability of the genetic testing technologies. The report also said that the U.S. market alone weighs more than 40% of the global market because of surge in the utilization of genetic testing in the areas of personalized medicines, oncology, and rare diseases. They include; strong R & D activities, existence of key players and favourable regulatory surroundings as flowed as the growth in this region.

However, Europe is another significant market representing the genetic testing market share due to the high level of healthcare, state funding of genomic projects, and increasing consumer interest in tests. The European market is expected to be moderate in terms of growth due to new regulatory policies that support the genetic research and genetic testing services market. However, the Asia Pacific market occupies a smaller percentage marketshare but is set to expand in the future as healthcare facilities are developed farther.

Active Key Players in the Genetic Testing Market:

23andMe, Inc. (USA)

Abbott Laboratories (USA)

Ancestry.com (USA)

Eurofins Genomics (Germany)

F. Hoffmann-La Roche AG (Switzerland)

Gene by Gene, Ltd. (USA)

Illumina, Inc. (USA)

Illumina, Inc. (USA)

Invitae Corporation (USA)

LabCorp (USA)

Myriad Genetics, Inc. (USA)

Pacific Biosciences of California, Inc. (USA)

PerkinElmer, Inc. (USA)

Quest Diagnostics (USA)

Thermo Fisher Scientific Inc. (USA)

Other Active Players.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Genetic Testing Market by Technology (2018-2032)

4.1 Genetic Testing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Next Generation Sequencing

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Array Technology

4.5 PCR – based Testing

4.6 FISH

4.7 Others

Chapter 5: Genetic Testing Market by Application (2018-2032)

5.1 Genetic Testing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Ancestry & Ethnicity

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Traits Screening

5.5 Genetic Disease Carrier Status

5.6 New Ba

Chapter 6: Genetic Testing Market by Screening (2018-2032)

6.1 Genetic Testing Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Health and Wellness – Predisposition/ Risk / Tendency

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

Chapter 7: Genetic Testing Market by Product (2018-2032)

7.1 Genetic Testing Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Consumables

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Equipment

7.5 software & Services

Chapter 8: Genetic Testing Market by Channel (2018-2032)

8.1 Genetic Testing Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Online

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Offline

Chapter 9: Genetic Testing Market by End User (2018-2032)

9.1 Genetic Testing Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Hospitals & Clinics

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Diagnostic Laboratories

9.5 Others

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Genetic Testing Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 23ANDME INC. (USA)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 ABBOTT LABORATORIES (USA)

10.4 ANCESTRY.COM (USA)

10.5 EUROFINS GENOMICS (GERMANY)

10.6 F. HOFFMANN-LA ROCHE AG (SWITZERLAND)

10.7 GENE BY GENE LTD. (USA)

10.8 ILLUMINA INC. (USA)

10.9 INVITAE CORPORATION (USA)

10.10 LABCORP (USA)

10.11 MYRIAD GENETICS INC. (USA)

10.12 PACIFIC BIOSCIENCES OF CALIFORNIA INC. (USA)

10.13 PERKINELMER INC. (USA)

10.14 QUEST DIAGNOSTICS (USA)

10.15 THERMO FISHER SCIENTIFIC INC. (USA)

10.16 OTHER ACTIVE PLAYERS

Chapter 11: Global Genetic Testing Market By Region

11.1 Overview

11.2. North America Genetic Testing Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size by Technology

11.2.4.1 Next Generation Sequencing

11.2.4.2 Array Technology

11.2.4.3 PCR – based Testing

11.2.4.4 FISH

11.2.4.5 Others

11.2.5 Historic and Forecasted Market Size by Application

11.2.5.1 Ancestry & Ethnicity

11.2.5.2 Traits Screening

11.2.5.3 Genetic Disease Carrier Status

11.2.5.4 New Ba

11.2.6 Historic and Forecasted Market Size by Screening

11.2.6.1 Health and Wellness – Predisposition/ Risk / Tendency

11.2.7 Historic and Forecasted Market Size by Product

11.2.7.1 Consumables

11.2.7.2 Equipment

11.2.7.3 software & Services

11.2.8 Historic and Forecasted Market Size by Channel

11.2.8.1 Online

11.2.8.2 Offline

11.2.9 Historic and Forecasted Market Size by End User

11.2.9.1 Hospitals & Clinics

11.2.9.2 Diagnostic Laboratories

11.2.9.3 Others

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Genetic Testing Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size by Technology

11.3.4.1 Next Generation Sequencing

11.3.4.2 Array Technology

11.3.4.3 PCR – based Testing

11.3.4.4 FISH

11.3.4.5 Others

11.3.5 Historic and Forecasted Market Size by Application

11.3.5.1 Ancestry & Ethnicity

11.3.5.2 Traits Screening

11.3.5.3 Genetic Disease Carrier Status

11.3.5.4 New Ba

11.3.6 Historic and Forecasted Market Size by Screening

11.3.6.1 Health and Wellness – Predisposition/ Risk / Tendency

11.3.7 Historic and Forecasted Market Size by Product

11.3.7.1 Consumables

11.3.7.2 Equipment

11.3.7.3 software & Services

11.3.8 Historic and Forecasted Market Size by Channel

11.3.8.1 Online

11.3.8.2 Offline

11.3.9 Historic and Forecasted Market Size by End User

11.3.9.1 Hospitals & Clinics

11.3.9.2 Diagnostic Laboratories

11.3.9.3 Others

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Genetic Testing Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size by Technology

11.4.4.1 Next Generation Sequencing

11.4.4.2 Array Technology

11.4.4.3 PCR – based Testing

11.4.4.4 FISH

11.4.4.5 Others

11.4.5 Historic and Forecasted Market Size by Application

11.4.5.1 Ancestry & Ethnicity

11.4.5.2 Traits Screening

11.4.5.3 Genetic Disease Carrier Status

11.4.5.4 New Ba

11.4.6 Historic and Forecasted Market Size by Screening

11.4.6.1 Health and Wellness – Predisposition/ Risk / Tendency

11.4.7 Historic and Forecasted Market Size by Product

11.4.7.1 Consumables

11.4.7.2 Equipment

11.4.7.3 software & Services

11.4.8 Historic and Forecasted Market Size by Channel

11.4.8.1 Online

11.4.8.2 Offline

11.4.9 Historic and Forecasted Market Size by End User

11.4.9.1 Hospitals & Clinics

11.4.9.2 Diagnostic Laboratories

11.4.9.3 Others

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Genetic Testing Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size by Technology

11.5.4.1 Next Generation Sequencing

11.5.4.2 Array Technology

11.5.4.3 PCR – based Testing

11.5.4.4 FISH

11.5.4.5 Others

11.5.5 Historic and Forecasted Market Size by Application

11.5.5.1 Ancestry & Ethnicity

11.5.5.2 Traits Screening

11.5.5.3 Genetic Disease Carrier Status

11.5.5.4 New Ba

11.5.6 Historic and Forecasted Market Size by Screening

11.5.6.1 Health and Wellness – Predisposition/ Risk / Tendency

11.5.7 Historic and Forecasted Market Size by Product

11.5.7.1 Consumables

11.5.7.2 Equipment

11.5.7.3 software & Services

11.5.8 Historic and Forecasted Market Size by Channel

11.5.8.1 Online

11.5.8.2 Offline

11.5.9 Historic and Forecasted Market Size by End User

11.5.9.1 Hospitals & Clinics

11.5.9.2 Diagnostic Laboratories

11.5.9.3 Others

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Genetic Testing Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size by Technology

11.6.4.1 Next Generation Sequencing

11.6.4.2 Array Technology

11.6.4.3 PCR – based Testing

11.6.4.4 FISH

11.6.4.5 Others

11.6.5 Historic and Forecasted Market Size by Application

11.6.5.1 Ancestry & Ethnicity

11.6.5.2 Traits Screening

11.6.5.3 Genetic Disease Carrier Status

11.6.5.4 New Ba

11.6.6 Historic and Forecasted Market Size by Screening

11.6.6.1 Health and Wellness – Predisposition/ Risk / Tendency

11.6.7 Historic and Forecasted Market Size by Product

11.6.7.1 Consumables

11.6.7.2 Equipment

11.6.7.3 software & Services

11.6.8 Historic and Forecasted Market Size by Channel

11.6.8.1 Online

11.6.8.2 Offline

11.6.9 Historic and Forecasted Market Size by End User

11.6.9.1 Hospitals & Clinics

11.6.9.2 Diagnostic Laboratories

11.6.9.3 Others

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Genetic Testing Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size by Technology

11.7.4.1 Next Generation Sequencing

11.7.4.2 Array Technology

11.7.4.3 PCR – based Testing

11.7.4.4 FISH

11.7.4.5 Others

11.7.5 Historic and Forecasted Market Size by Application

11.7.5.1 Ancestry & Ethnicity

11.7.5.2 Traits Screening

11.7.5.3 Genetic Disease Carrier Status

11.7.5.4 New Ba

11.7.6 Historic and Forecasted Market Size by Screening

11.7.6.1 Health and Wellness – Predisposition/ Risk / Tendency

11.7.7 Historic and Forecasted Market Size by Product

11.7.7.1 Consumables

11.7.7.2 Equipment

11.7.7.3 software & Services

11.7.8 Historic and Forecasted Market Size by Channel

11.7.8.1 Online

11.7.8.2 Offline

11.7.9 Historic and Forecasted Market Size by End User

11.7.9.1 Hospitals & Clinics

11.7.9.2 Diagnostic Laboratories

11.7.9.3 Others

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

Q1: What would be the forecast period in the Genetic Testing Market research report?

A1: The forecast period in the Genetic Testing Market research report is 2024-2032.

Q2: Who are the key players in the Genetic Testing Market?

A2: 23andMe, Inc. (USA), Abbott Laboratories (USA), Ancestry.com (USA), Eurofins Genomics (Germany), F. Hoffmann-La Roche AG (Switzerland), Gene by Gene, Ltd. (USA), Illumina, Inc. (USA), Invitae Corporation (USA), LabCorp (USA), Myriad Genetics, Inc. (USA), Pacific Biosciences of California, Inc. (USA), PerkinElmer, Inc. (USA), Quest Diagnostics (USA), Thermo Fisher Scientific Inc. (USA), and Other Active Players.

Q3: What are the segments of the Genetic Testing Market?

A3: The Genetic Testing Market is segmented into Technology, Application ,Product ,Channel , End User and region. By Technology, the market is categorized into Next Generation Sequencing, Array Technology ,PCR – based Testing ,FISH ,Others. By Application, the market is categorized into Ancestry & Ethnicity ,Traits Screening Genetic Disease Carrier Status ,New Baby Screening ,Health and Wellness – Predisposition/ Risk / Tendency By product ,The market is categorized into Consumables ,Equipment ,software & Services .By Channel ,the market is Categorized into Online ,Offline . By End User, the market is categorized into Hospitals & Clinics ,Diagnostic Laboratories ,Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Q4: What is the Genetic Testing Market?

A4: The genetic testing market refers to the industry focused on the use of genetic tests to analyze an individual’s DNA to identify changes or mutations that could lead to inherited conditions, predispositions to certain diseases, or the likelihood of passing traits to offspring. These tests are primarily used for diagnostics, personalized medicine, ancestry tracing, and reproductive health management. Genetic testing is conducted using various technologies such as polymerase chain reaction (PCR), next-generation sequencing (NGS), and microarray analysis, among others.

Q5: How big is the Genetic Testing Market?

A5: Genetic Testing Market Size Was Valued at USD 7,420.07 Million in 2023, and is Projected to Reach USD 41254.98 Million by 2032, Growing at a CAGR of 21.0% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!