Stay Ahead in Fast-Growing Economies.

Browse Reports NowAnimal Health Market – Comprehensive Study Report & Recent Trends

It has been estimated that globally 20% of livestock production is lost due to disease each year (24), impacting animal welfare and reducing animal productivity resulting in less sustainable farming.

IMR Group

Description

Animal Health Market Synopsis

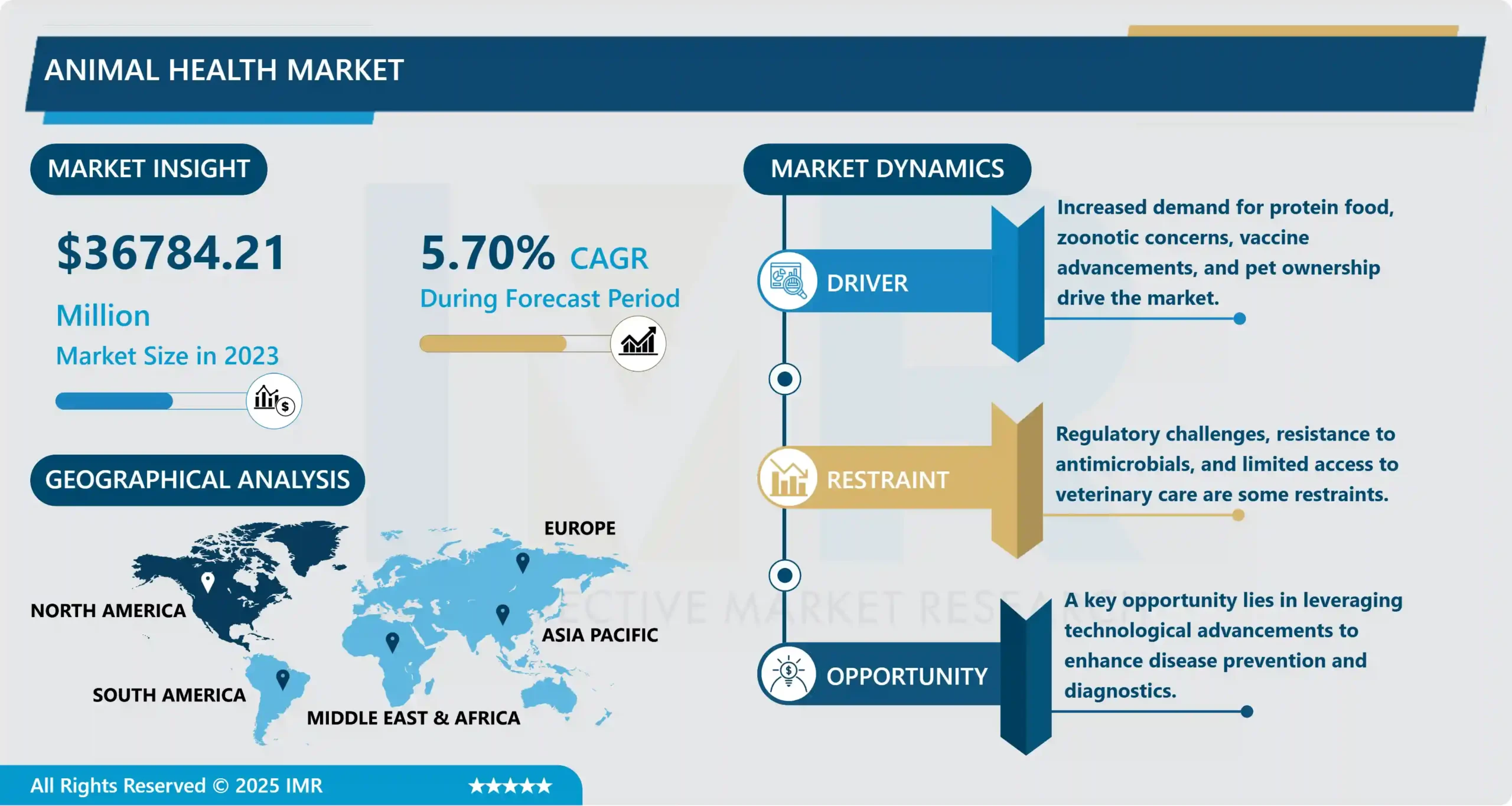

Animal Health Market Size Was Valued at USD 36784.21 Million in 2023 and is Projected to Reach USD 60580.98 Million by 2032, Growing at a CAGR of 5.7% From 2024-2032.

It has been estimated that globally 20% of livestock production is lost due to disease each year (24), impacting animal welfare and reducing animal productivity resulting in less sustainable farming. By 2050 it is estimated that the world will require 70% more animal protein (23), as the human population is projected to increase from 8 billion to 9.7 billion along with a growth in living standards in the developing world. This will be accompanied by a steep rise in demand for animal produce to feed and nourish a growing world population.

It’s estimated that 1 in 5 farm animals are lost due to diseases each year, while many more animals suffer the effects of illness (26). The animal health industry is committed to reducing the number of animals lost to disease each year and ensuring a consistent food supply by improving animal health through research and development (R&D). Emerging technologies and scientific advancements like artificial intelligence and new-generation vaccines provide greater opportunities to predict, diagnose, prevent, and treat animal illness more quickly, accurately, and safely (27). A wide range of vaccines has been developed for livestock diseases, to prevent and control the burden of diseases on farms.

For countries to strive for a better and more sustainable future for all, the United Nations in 2015 produced the 2030 agenda for sustainable development. This agenda lays out 17 sustainable development goals (SDG) as a blueprint that all 193 United Nations member states agreed on; to end poverty, ensure prosperity & protect the planet. Animal medicines help ensure food from animals is safe to eat and help improve food yield, contributing to the supply of affordable food from animals. Global egg production was likely reduced by 3 million tonnes by disease, equating to a loss of US$5.6 billion. This is the equivalent of wiping out the United Kingdom’s £1.2 billion egg market nearly four times over. A 60% global vaccination rate for beef cattle is associated with a 52.6% rise in production equivalent to the beef consumption needs of 3.1 billion people. Every 1% reduction in dairy cattle disease rates would increase production enough to meet the average dairy needs of 80.5 million people. The increasing prevalence of zoonotic diseases, such as animal flu, tick infestation, and Lyme disease, are key factors that can drive the growth of the animal health market.

Animal Health Market Trend Analysis

The trend of adopting pets for companionship is contributing to the need for proper animal health.

The growing population of companion animal owners has led to increasing concerns among owners about their pets’ health and nutrition, leading to a rise in demand for veterinary services. This, in turn, is driving the demand for diversified companion healthcare products such as vaccines, feeding products, nutritional supplements, and drugs for various diseases. The accessibility of advanced veterinary care services and the development of novel drugs and treatments have encouraged pet owners to provide better healthcare to their companion animals, fuelling the market for companion animal health.

The rise of online sales channels and Online (E-commerce) has made it more convenient for pet owners to purchase veterinary products and services, which has also contributed to the growth of the market. North America is the largest market for companion animal health products, followed by Europe. Asia-Pacific is expected to have the highest growth rate in the coming years due to the increasing number of pet owners and their growing awareness about animal health. Globally, pet ownership is on the rise, with the US having the highest pet ownership rate, followed by Europe and Asia. Over 60% of US households own at least one pet, which indicates a high demand for companion animal health products and services.

Opportunity

A key opportunity in the animal health market lies in leveraging technological advancements to enhance disease prevention and diagnostics.

The animal health market reached a new high in 2021, driven by increased demand for protein food, the prevalence of zoonotic and food-borne diseases, advancements in vaccines and medications, and pet ownership. The global animal health market was estimated at $39.9 billion in 2021. The U.S. accounts for nearly one-third of the global market (32.6%), generating an estimated $13.0 billion in sales in 2021. In the U.S. animal health products make up about 2% of the total biopharmaceutical spending ($13.0 billion in sales of animal health products compared to $574 billion for human medicines). The animal health market has continued to grow, even with COVID-19 restrictions and supply chain challenges.

Like other innovative manufacturing industries, the animal health industry has been less affected by economic downturns compared to its counterparts.6 While most industries suffered losses since the COVID outbreak, the animal health industry has accelerated in the U.S. market. After maintaining a steady growth of an average of 3% per year from 2016 to 2019, sales of animal health products in the U.S. increased by an average of 10% annually since 2019. Medicines and vaccines enable a robust and essential livestock industry by keeping food animals healthy and protecting the public from disease outbreaks. Healthy companion animals are the cornerstone of the animal services sector and provide physical and emotional benefits to their human owners. The benefits of animal health products to production are substantial and are recognized by global organizations to be essential to food security and human health

The animal healthcare sector can be broadly categorized into three segments, namely pharmaceuticals, veterinary services, and medical devices. Several factors are driving the growth of this market, including increasing animal health expenditure, the prevalence of diseases in animals concerns over zoonoses, and the trend of pet humanization. Animal health involves the conservation and safeguarding of animals from various diseases, as well as the provision of essential veterinary treatments. It also entails the regular monitoring of animals to prevent disease outbreaks through the use of proper medications and diagnostic products. Ensuring animal health is crucial for maintaining a safe food supply and protecting public health from diseases transmitted by animals. Additionally, maintaining proper animal health aids in providing adequate control and preventive measures to curb the spread of zoonotic diseases among animals and humans.

Animal Health Market Segment Analysis:

Animal Health Market is Segmented on the basis of Animal Type, Product, End-users, and Distribution Channel.

By Animal Type, Commercial Production Animal Segment Is Expected to Dominate the Market During the Forecast Period

The livestock and poultry raised for meat, milk, and other products fall within the commercial sector of the animal health market. With the increasing need for animal-based products such as meat and dairy, producers focus on keeping herd and flock health a top priority to guarantee productivity and quality of products. The focus on protecting animal health leads to an increased need for preventive actions like vaccinations, parasite control, and disease management, which in turn enhances the market for products such as vaccines, pharmaceuticals, and hygiene solutions for animals.

Partnership between commercial producers and veterinary experts enhances animal health management practices, driving market growth forward. For instance, the Asian Development Bank’s funding in Zenex Animal Health India is intended to improve the manufacturing and delivery of high-quality animal health products, ultimately boosting farmer earnings by reducing the risk of livestock diseases.

In 2023, the market was mainly led by the production animal sector due to growing worries about food safety and sustainability. Government healthcare organizations and other market stakeholders prioritize precision livestock farming techniques, biosecurity measures, and vaccination programs in order to fulfill global food demand. The emphasis on updating livestock agriculture is projected to maintain the sector’s leading position in the future. In general, the commercial sector of the animal health industry is flourishing because of the importance of preserving herd and flock health to maximize productivity and product quality, aided by partnerships between producers and veterinarians and an increasing focus on food safety and sustainability.

By Product, the Pharmaceuticals Drugs Segment Held the Largest Share In 2023

In the animal health market of 2023, the pharmaceutical sector led the way, securing a significant portion of around 43%. This part consists of multiple items such as anti-inflammatory drugs, antibiotics, parasiticides, pain relievers, and other goods. Vaccines and drugs, such as medicines, are vital for preserving the well-being of domestic and farm animals by preventing and treating a range of illnesses. Pharmaceutical companies dominate the market by providing customized healthcare options for vets, animal breeders, and pet parents. The ongoing progress in veterinary medicine is fueling the growth of the pharmaceutical industry, with a greater emphasis on funding research and development (R&D) to create new and innovative drugs for different health issues.

The increasing recognition of the significance of animal health by pet owners, farmers, and animal caretakers is leading to a rise in the need for pharmaceuticals. The pharmaceutical industry’s dominant market position is maintained through the product development efforts and market knowledge of key players in the sector. Companies are concentrating on creating customized medications for particular animal types and health requirements, like Hacarus Inc.’s ECG system designed for early detection of heart disease in dogs.

Moreover, progress in pharmaceutical technology, including controlled-release formulas and personalized medicine, improves the effectiveness of treatments. Organizations such as the Canadian Food Inspection Agency are responsible for ensuring the safety and effectiveness of veterinary biologics such as vaccines, leading to enhanced consumer trust and market expansion.

The pharmaceutical industry’s leading position in animal health can be attributed to its vital work in preventing and treating diseases, continually improving drug development, and raising awareness of animal health among important stakeholders.

Animal Health Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

The animal health market is seeing notable growth worldwide, with North America at the forefront, maintaining a market share of approximately 32% by 2023. The region’s strong measures taken by the government and animal welfare organizations are credited for this dominance in improving animal health. Moreover, market growth is being fueled by technological progress, increased occurrences of zoonotic diseases, and a rise in the number of pet owners.

The Asia Pacific region is set to experience rapid growth, with a growth rate of over 10% shortly, driven by higher investments in animal healthcare and initiatives to make medications more affordable for consumers. Just like that, Europe’s market for animal health holds onto a large portion, aided by an increasing number of animal diseases and rising spending on vet care. North America is projected to continue leading during the forecast period, due to its advanced research and development infrastructure and rising rates of pet adoption. Joint efforts by leading companies to improve research and development capabilities and maintain high-quality standards continue to strengthen market demand.

Efforts led by groups such as Best Friends Animal Society and the California Animal Welfare Funders Collaborative are supporting pet adoption and financial assistance for animal welfare programs, leading to an increase in the market. Additionally, the rise in knowledge regarding pet healthcare, as demonstrated by the high rates of pet ownership in Canada and the willingness to invest in pet healthcare, is projected to drive the need for animal health products and services. In general, the worldwide animal health industry is set to experience notable expansion, spurred by regional elements like government programs, technological progress, growing pet ownership, and heightened concern for animal well-being.

Animal Health Market Active Players

Zoetis (USA)

Ceva Santé Animale (France)

Merck & Co., Inc. (USA)

Vetoquinol S.A. (France)

Boehringer Ingelheim GmbH (Germany)

Elanco (USA)

Virbac (France)

Mars Inc. (USA)

Dechra Pharmaceuticals Plc (UK)

Idexx Laboratories, Inc. (USA)

Bayer AG (Germany)

Hester Biosciences Ltd. (India)

Intas Pharmaceuticals Ltd. (India)

Merial (France)

Alvira Animal Health Limited (India)

Zydus Animal Health (India)

Norbrook Laboratories Limited (UK)

Phibro Animal Health Corporation (USA)

Norbrook Laboratories, Inc. (USA)

Biogenesis Bago (Argentina)

Heska (USA)

Neogen (USA)

Novartis (Switzerland)

Thermo Fisher Scientific (USA)

Intervet International B.V. (Netherlands)

Emergent BioSolutions, Inc. (USA)

CSL Limited (Australia)

B. Braun Vet Care (Germany)

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Animal Health Market by Animal Type (2018-2032)

4.1 Animal Health Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Commercial Production Animals

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Companion Animals

Chapter 5: Animal Health Market by Product (2018-2032)

5.1 Animal Health Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Pharmaceuticals Drugs

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Vaccines

5.5 Feed Additives

5.6 Diagnostics Devices

Chapter 6: Animal Health Market by End-users (2018-2032)

6.1 Animal Health Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Veterinary Hospitals & Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Animal Care & Rehabilitation Centers

6.5 Point-of-care/In-house Testing

Chapter 7: Animal Health Market by Distribution Channel (2018-2032)

7.1 Animal Health Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Online (E-commerce)

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Offline (Hospital/ Clinic/ Pharmacy stores)

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Animal Health Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ZOETIS (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 CEVA SANTÉ ANIMALE (FRANCE)

8.4 MERCK & COINC. (USA)

8.5 VETOQUINOL S.A. (FRANCE)

8.6 BOEHRINGER INGELHEIM GMBH (GERMANY)

8.7 ELANCO (USA)

8.8 VIRBAC (FRANCE)

8.9 MARS INC. (USA)

8.10 DECHRA PHARMACEUTICALS PLC (UK)

8.11 IDEXX LABORATORIES INC. (USA)

8.12 BAYER AG (GERMANY)

8.13 HESTER BIOSCIENCES LTD. (INDIA)

8.14 INTAS PHARMACEUTICALS LTD. (INDIA)

8.15 MERIAL (FRANCE)

8.16 ALVIRA ANIMAL HEALTH LIMITED (INDIA)

8.17 ZYDUS ANIMAL HEALTH (INDIA)

8.18 NORBROOK LABORATORIES LIMITED (UK)

8.19 PHIBRO ANIMAL HEALTH CORPORATION (USA)

8.20 NORBROOK LABORATORIES INC. (USA)

8.21 BIOGENESIS BAGO (ARGENTINA)

8.22 HESKA (USA)

8.23 NEOGEN (USA)

8.24 NOVARTIS (SWITZERLAND)

8.25 THERMO FISHER SCIENTIFIC (USA)

8.26 INTERVET INTERNATIONAL B.V. (NETHERLANDS)

8.27 EMERGENT BIOSOLUTIONS INC. (USA)

8.28 CSL LIMITED (AUSTRALIA)

8.29 B. BRAUN VET CARE (GERMANY)

8.30 MEDTRONIC (USA)

Chapter 9: Global Animal Health Market By Region

9.1 Overview

9.2. North America Animal Health Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Animal Type

9.2.4.1 Commercial Production Animals

9.2.4.2 Companion Animals

9.2.5 Historic and Forecasted Market Size by Product

9.2.5.1 Pharmaceuticals Drugs

9.2.5.2 Vaccines

9.2.5.3 Feed Additives

9.2.5.4 Diagnostics Devices

9.2.6 Historic and Forecasted Market Size by End-users

9.2.6.1 Veterinary Hospitals & Clinics

9.2.6.2 Animal Care & Rehabilitation Centers

9.2.6.3 Point-of-care/In-house Testing

9.2.7 Historic and Forecasted Market Size by Distribution Channel

9.2.7.1 Online (E-commerce)

9.2.7.2 Offline (Hospital/ Clinic/ Pharmacy stores)

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Animal Health Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Animal Type

9.3.4.1 Commercial Production Animals

9.3.4.2 Companion Animals

9.3.5 Historic and Forecasted Market Size by Product

9.3.5.1 Pharmaceuticals Drugs

9.3.5.2 Vaccines

9.3.5.3 Feed Additives

9.3.5.4 Diagnostics Devices

9.3.6 Historic and Forecasted Market Size by End-users

9.3.6.1 Veterinary Hospitals & Clinics

9.3.6.2 Animal Care & Rehabilitation Centers

9.3.6.3 Point-of-care/In-house Testing

9.3.7 Historic and Forecasted Market Size by Distribution Channel

9.3.7.1 Online (E-commerce)

9.3.7.2 Offline (Hospital/ Clinic/ Pharmacy stores)

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Animal Health Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Animal Type

9.4.4.1 Commercial Production Animals

9.4.4.2 Companion Animals

9.4.5 Historic and Forecasted Market Size by Product

9.4.5.1 Pharmaceuticals Drugs

9.4.5.2 Vaccines

9.4.5.3 Feed Additives

9.4.5.4 Diagnostics Devices

9.4.6 Historic and Forecasted Market Size by End-users

9.4.6.1 Veterinary Hospitals & Clinics

9.4.6.2 Animal Care & Rehabilitation Centers

9.4.6.3 Point-of-care/In-house Testing

9.4.7 Historic and Forecasted Market Size by Distribution Channel

9.4.7.1 Online (E-commerce)

9.4.7.2 Offline (Hospital/ Clinic/ Pharmacy stores)

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Animal Health Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Animal Type

9.5.4.1 Commercial Production Animals

9.5.4.2 Companion Animals

9.5.5 Historic and Forecasted Market Size by Product

9.5.5.1 Pharmaceuticals Drugs

9.5.5.2 Vaccines

9.5.5.3 Feed Additives

9.5.5.4 Diagnostics Devices

9.5.6 Historic and Forecasted Market Size by End-users

9.5.6.1 Veterinary Hospitals & Clinics

9.5.6.2 Animal Care & Rehabilitation Centers

9.5.6.3 Point-of-care/In-house Testing

9.5.7 Historic and Forecasted Market Size by Distribution Channel

9.5.7.1 Online (E-commerce)

9.5.7.2 Offline (Hospital/ Clinic/ Pharmacy stores)

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Animal Health Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Animal Type

9.6.4.1 Commercial Production Animals

9.6.4.2 Companion Animals

9.6.5 Historic and Forecasted Market Size by Product

9.6.5.1 Pharmaceuticals Drugs

9.6.5.2 Vaccines

9.6.5.3 Feed Additives

9.6.5.4 Diagnostics Devices

9.6.6 Historic and Forecasted Market Size by End-users

9.6.6.1 Veterinary Hospitals & Clinics

9.6.6.2 Animal Care & Rehabilitation Centers

9.6.6.3 Point-of-care/In-house Testing

9.6.7 Historic and Forecasted Market Size by Distribution Channel

9.6.7.1 Online (E-commerce)

9.6.7.2 Offline (Hospital/ Clinic/ Pharmacy stores)

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Animal Health Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Animal Type

9.7.4.1 Commercial Production Animals

9.7.4.2 Companion Animals

9.7.5 Historic and Forecasted Market Size by Product

9.7.5.1 Pharmaceuticals Drugs

9.7.5.2 Vaccines

9.7.5.3 Feed Additives

9.7.5.4 Diagnostics Devices

9.7.6 Historic and Forecasted Market Size by End-users

9.7.6.1 Veterinary Hospitals & Clinics

9.7.6.2 Animal Care & Rehabilitation Centers

9.7.6.3 Point-of-care/In-house Testing

9.7.7 Historic and Forecasted Market Size by Distribution Channel

9.7.7.1 Online (E-commerce)

9.7.7.2 Offline (Hospital/ Clinic/ Pharmacy stores)

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Animal Health Market research report?

A1: The forecast period in the Animal Health Market research report is 2024-2032.

Q2: Who are the key players in the Animal Health Market?

A2: Zoetis (USA), Ceva Santé Animale (France), Merck & Co., Inc. (USA), Vetoquinol S.A. (France), Boehringer Ingelheim GmbH (Germany), Elanco (USA), Virbac (France), Mars Inc. (USA), Dechra Pharmaceuticals Plc (UK), Idexx Laboratories, Inc. (USA), Bayer AG (Germany), Hester Biosciences Ltd. (India), Intas Pharmaceuticals Ltd. (India), Merial (France), Alvira Animal Health Limited (India), Zydus Animal Health (India), Norbrook Laboratories Limited (UK), Phibro Animal Health Corporation (USA), Norbrook Laboratories, Inc. (USA), Biogenesis Bago (Argentina), Heska (USA), Neogen (USA), Novartis (Switzerland), Thermo Fisher Scientific (USA), Intervet International B.V. (Netherlands), Emergent BioSolutions, Inc. (USA), CSL Limited (Australia), B. Braun Vet Care (Germany), Medtronic (USA), and Other Active Players.

Q3: What are the segments of the Animal Health Market?

A3: The Animal Health Market is segmented into Animal Type, Product, End-users, Distribution Channel, and region. By Animal Type, the market is categorized into Commercial Production Animals and companion Animals. By Product, the market is categorized into Pharmaceuticals Drugs, Vaccines, Feed Additives, and Diagnostics Devices. By End-users, the market is categorized into Veterinary Hospitals & Clinics, Animal Care & Rehabilitation Centers, and Point-of-care/In-house Testing. By Distribution Channel, the market is categorized into Online (E-commerce) and offline (Hospital/ Clinic/ Pharmacy stores. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Animal Health Market?

A4: The animal health market refers to the sector involved in the development, manufacturing, and distribution of products and services aimed at promoting the health and well-being of animals. This market encompasses various segments, including pharmaceuticals, vaccines, medical devices, diagnostics, and veterinary services.

Q5: How big is the Animal Health Market?

A5: Animal Health Market Size Was Valued at USD 36784.21 Million in 2023, and is Projected to Reach USD 60580.98 Million by 2032, Growing at a CAGR of 5.7% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!