Stay Ahead in Fast-Growing Economies.

Browse Reports NowBot Security Market – Comprehensive Study Report & Recent Trends

This concern has spurred tremendous growth in the bot security market over the last few years due to increased automation and AI applications across markets. With companies adopting chatbots, virtual assistants, and other similar applications for establishing communications and interaction with customers as well as for managing accreditations and operations, it has become highly critical to protect these bots from hacking and cyber threats.

IMR Group

Description

Bot Security Market Synopsis

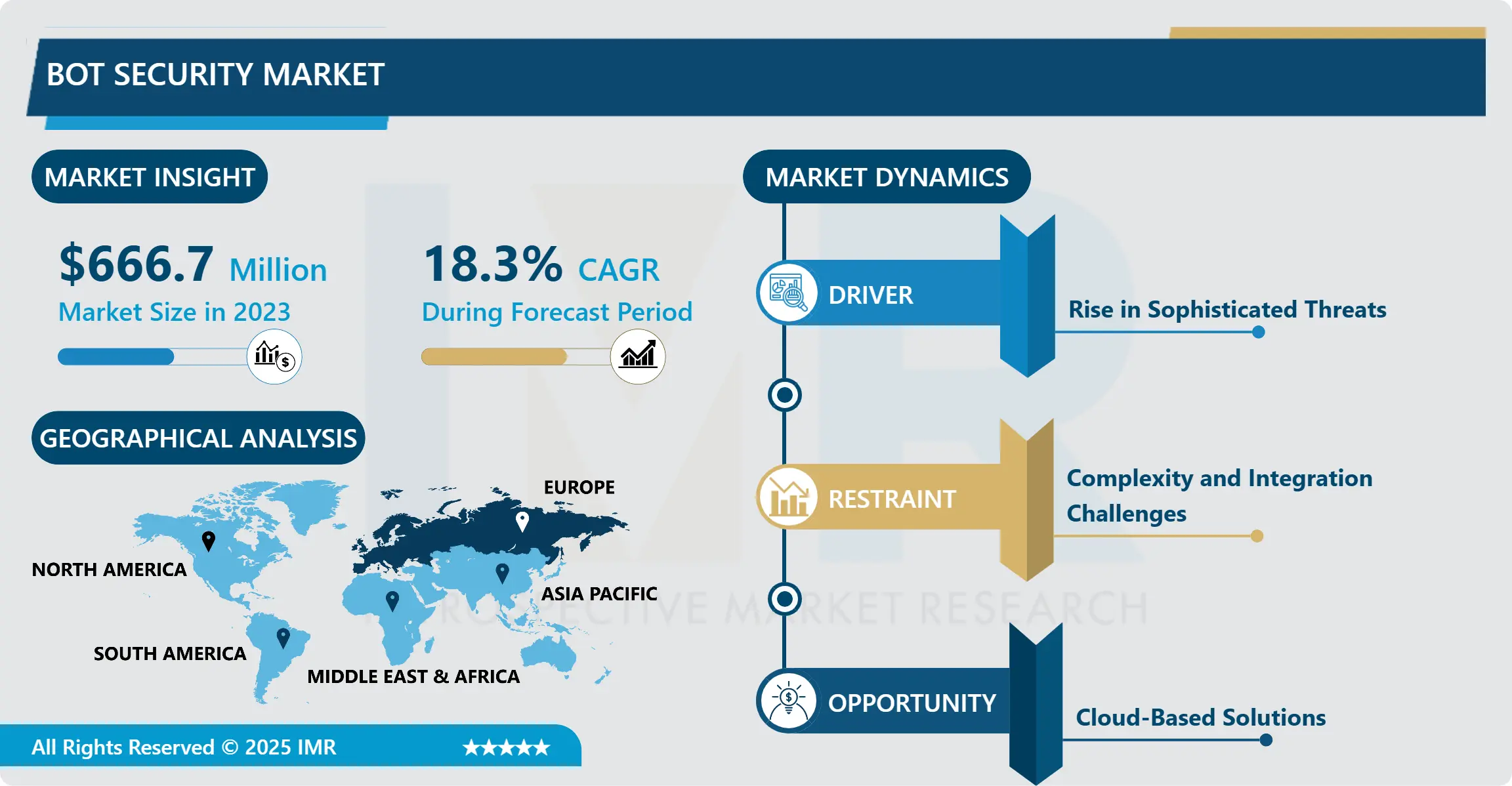

Bot Security Market Size Was Valued at USD 666.7 Million in 2023 and is Projected to Reach USD 3025.5 Million by 2032, Growing at a CAGR of 18.3% From 2024-2032.

This concern has spurred tremendous growth in the bot security market over the last few years due to increased automation and AI applications across markets. With companies adopting chatbots, virtual assistants, and other similar applications for establishing communications and interaction with customers as well as for managing accreditations and operations, it has become highly critical to protect these bots from hacking and cyber threats. In the same regard, another aspect that has generated significant demand for bot security solutions is the increasing threat to bots from cyber threats. Cybercriminals actively adapt behavior that targets various weaknesses in the structure and operation of bot systems, resulting in data leaks, fraud, and other types of cybercrimes. This has led organizations to develop strong and effective bot security measures within their systems to counter the threat of losing their valuable resources and compromising the privacy of users.

Also, due to the EU General Data Protection Regulation and the California Consumer Privacy Act rules, companies were forced to develop a strategy that would secure bots from malicious attacks. Employees who negotiate contracts and other documents digitally are exposed to losing customer data processed by bots; this can lead to reputational risk and legal repercussions creating demand for comprehensive bot security solutions.

This implies that the continuous advancement of bot attacks requires new and improved bot security measures, thus expanding the market for products in this division. Cybercriminals are already using complex approaches such as machine learning algorithms and natural language processing to perform complex attacks that easily circumvent most traditional security steps and measures. As a result, vendors are still developing more advanced security technologies, including behavioral analysis and anomaly detection, to encase the new threats appearing in the internet space in real-time.

In addition, high levels of acknowledgment by business entities operating across industries of the need to safeguard bots are propelling the market. Companies are waking up to the reality that these insecure bots pose a serious threat to their systems, and there is an increased effort to lock down these systems to eliminate the risk. Because of a growing awareness of these risks, customers are investing in both security solutions that are expanding the market.

However, the bot security market is not without its problems, some of which include an overall lack of qualified cybersecurity personnel in organizations that can adequately protect and manage bot systems despite the good growth outlook. Also, the bot nature of the ecosystems is dynamically expanding across different channels and platforms, which creates integration and interaction complexities for security solutions. Nonetheless, the impetus towards AI improvement in security technologies and active vendors and cybersecurity key partnerships will help in overcoming these challenges and further propelling demand for the bot security market.

Bot Security Market Trend Analysis

Evolving Threat Landscape

While a new wave of cyber threats is on the rise, businesses are getting more and more attacks with the use of bots. These attacks extend from the simple bot impersonating several users who try to log in with a set of credentials different from the actual ones to a complex bot that completely mimics a human persona and hence is capable of causing a lot of harm to business enterprises cutting across all industries.

As the frequency and severity of bot attacks are increasingly affecting businesses adversely there is a greater need for well-guarded bot security. Businesses are looking for solutions that can identify and address all types of bots, including those that are currently known and those that may escalate in the future in real time.

Mimicking the pace of emerging threats, technological enhancements are introducing innovation in the bot security market. Detection techniques that apply AI and machine learning algorithms for anomaly detection or behavioral analysis have become a part of every bot security solution to increase the precision of detections and immediate reactions.

This has led to growth in the bot security market given the increasing rates at which bots have become a nuisance to websites. It is evident that through necessity modern vendors are expanding their portfolios across various industries and organizational structures thus spurring market growth and competition.

Adoption of AI and Machine Learning

Firstly, and most importantly, there is the factor of the constant development and growth in the complexity of cyberspace threats, which requires enhanced and more versatile protection mechanisms. AI and machine learning give bots the capacity to process vast quantities of data in real-time, with advanced abilities to identify threats and adapt to them.

Secondly, thanks to the popularity gain of using bots in customer relations, sales, and other spheres, there is a need for enhanced security. About the use of AI-powered bots not only did it improve operational efficiency but it also ensured the security was heightened by the constant learning of new threats.

Thirdly, there are legal and regulatory requirements like GDPR and CCPA which promote compliance with extreme data protection, prompting organizations to incorporate security solutions from AI bots. Finally, awareness about the risks arising from bot attacks such as the loss of confidential information by companies and other forms of damages is encouraging the implementation of AI and machine learning technologies to prevent attacks before they occur.

Bot Security Market Segment Analysis:

Bot Security Market Segmented based By Component, By Security Type, By Deployment Mode, By Organization Size, and By Verticals

By Component, Standalone Solution is expected to dominate the market during the forecast period.

The global market of bot security is expanding due to the demand for chatbots or virtual assistants present in all industries. Because these solutions embody high levels of AI to assist organizations in handling customer engagement and automating diverse operations, it becomes critical to safeguard them against cyber threats. The market can also be divided into standalone solutions and services to strengthen bot ecosystems both of which are viable segments.

Standalone solutions include a rather vast continuum of software originally characterized as programs that guard chatbots and other virtual assistants against various attacks. Generally, these solutions have features like threat detection, detection of anomalies, and behavior analysis to ensure that any potential attacks are detected and prevented. Organizations can implement standalone bot security solutions that will prevent bot solutions from being impacted by external threats so that organizations’ digital assets are protected, and bot solutions remain fully functional.

For reference, there are bot security services that provide further enhanced layers as eDiscovery against standalone solutions. They may also include threat intelligence, security assessment, and incident response services that would offer organizations professional support to adequately address issues of bot exploitation. Also, a bot security service normally provides round-the-clock monitoring and frequent updates to the security to make them airtight to newer threats.

Considering the fact that bots have become a significant part of customers’ and businesses’ lives throughout their interactions and work, it is crucial to provide solid protection for such technologies. In ways general and specific, organizations can learn to manage risks posed by bot vulnerabilities and remain faithful to the principles of trust and integrity in their engagements with clients, consumers, counterparts, and citizens. That being said, there will always be novel radical security patterns and Software that will cover new threats and ensure the future of bot security in automated conversation.

By Verticals, the Retail and e-commerce segment held the largest share in 2023

In the realm of Retail and e-commerce, the significance of bot security cannot be overstated. With the rise of automated bots that can mimic human behavior, online retailers face challenges such as inventory manipulation, price scraping, and fraudulent transactions. Implementing robust bot security measures is imperative to safeguard customer data, protect brand reputation, and ensure fair competition within the industry.

Similarly, in the Media and Entertainment sector, bot security plays a crucial role in combating piracy, content scraping, and fake engagement. Content creators and distributors rely on secure platforms to prevent unauthorized access and distribution of copyrighted material, preserving their intellectual property rights and revenue streams.

In Travel and Tourism, but security is essential for preventing automated ticket scalping, inventory hoarding, and fraudulent bookings. By deploying advanced bot detection and mitigation solutions, travel companies can maintain fair pricing, enhance customer trust, and protect their online infrastructure from malicious attacks.

In the BFSI (Banking, Financial Services, and Insurance) sector, but security is paramount for safeguarding sensitive financial data, preventing account takeover attacks, and detecting fraudulent transactions in real-time. Banks and financial institutions invest heavily in cybersecurity solutions to mitigate risks associated with automated bot threats and ensure regulatory compliance.

Bot Security Market Regional Insights:

Europe holds a significant market share

Exploring the global scenario, Europe comprises a significant market share of the bot security market and is considered as one of the most influential regions. Next, discussing the potential of/the current state of Europe which serves as an attractive zone to invest in bot security solutions as it possesses a technologically developed environment and strict legal requirements.

Enterprises all over the concerned region pay attention to security issues and this, in turn, increases the need for strong barriers to protect against evolving, complex bot threats. The market driving force in the European market for bot security solutions is the increasing realization of the harm bots pose to business entities and individuals.

Globally, there has been a rise in successful cyber threats, which in the past were seen as a limited threat posed mostly to large corporations. Hence, businesses in Europe are increasing investment in innovative bot detection and prevention tools to protect their digital assets and maintain client loyalty.

However, one political development has been the foundation of the European Union in the General Data Protection Regulation (GDPR) in determining the overall security systems of the region. Global data protection laws such as GDPR must be strictly followed and enforced, and failure to protect data attracts severe penalties that ensure organizations enhance security from malicious bots that can lead to the loss of valuable information. As a result, there is an a priori need for total bot security solutions that can meet the GDPR requirements across different industries.

Active Key Players in the Bot Security Market

Akamai Technologies

Imperva

PerimeterX

Cloudflare

Radware

Fastly

F5

Sophos, and Other Active Players

Key Industry Developments in the Bot Security Market:

In December 2023, Thales acquired Imperva, creating a global cybersecurity leader.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Bot Security Market by Component (2018-2032)

4.1 Bot Security Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Standalone Solution

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Services

Chapter 5: Bot Security Market by Security Type (2018-2032)

5.1 Bot Security Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Web Security

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Mobile Security

5.5 API Security

Chapter 6: Bot Security Market by Deployment Mode (2018-2032)

6.1 Bot Security Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Cloud

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 On-Premises

Chapter 7: Bot Security Market by Organization Size (2018-2032)

7.1 Bot Security Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Small and Medium-sized Enterprises (SMEs)

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Large Enterprises

Chapter 8: Bot Security Market by Verticals (2018-2032)

8.1 Bot Security Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Retail and eCommerce

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Media and Entertainment

8.5 Travel and Tourism

8.6 BFSI

8.7 Telecom

8.8 Government and Defense

8.9 Healthcare

8.10 Others

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Bot Security Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 AKAMAI TECHNOLOGIES

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 IMPERVA

9.4 PERIMETERX

9.5 CLOUDFLARE

9.6 RADWARE

9.7 FASTLY

9.8 F5

9.9 SOPHOS

Chapter 10: Global Bot Security Market By Region

10.1 Overview

10.2. North America Bot Security Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Component

10.2.4.1 Standalone Solution

10.2.4.2 Services

10.2.5 Historic and Forecasted Market Size by Security Type

10.2.5.1 Web Security

10.2.5.2 Mobile Security

10.2.5.3 API Security

10.2.6 Historic and Forecasted Market Size by Deployment Mode

10.2.6.1 Cloud

10.2.6.2 On-Premises

10.2.7 Historic and Forecasted Market Size by Organization Size

10.2.7.1 Small and Medium-sized Enterprises (SMEs)

10.2.7.2 Large Enterprises

10.2.8 Historic and Forecasted Market Size by Verticals

10.2.8.1 Retail and eCommerce

10.2.8.2 Media and Entertainment

10.2.8.3 Travel and Tourism

10.2.8.4 BFSI

10.2.8.5 Telecom

10.2.8.6 Government and Defense

10.2.8.7 Healthcare

10.2.8.8 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Bot Security Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Component

10.3.4.1 Standalone Solution

10.3.4.2 Services

10.3.5 Historic and Forecasted Market Size by Security Type

10.3.5.1 Web Security

10.3.5.2 Mobile Security

10.3.5.3 API Security

10.3.6 Historic and Forecasted Market Size by Deployment Mode

10.3.6.1 Cloud

10.3.6.2 On-Premises

10.3.7 Historic and Forecasted Market Size by Organization Size

10.3.7.1 Small and Medium-sized Enterprises (SMEs)

10.3.7.2 Large Enterprises

10.3.8 Historic and Forecasted Market Size by Verticals

10.3.8.1 Retail and eCommerce

10.3.8.2 Media and Entertainment

10.3.8.3 Travel and Tourism

10.3.8.4 BFSI

10.3.8.5 Telecom

10.3.8.6 Government and Defense

10.3.8.7 Healthcare

10.3.8.8 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Bot Security Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Component

10.4.4.1 Standalone Solution

10.4.4.2 Services

10.4.5 Historic and Forecasted Market Size by Security Type

10.4.5.1 Web Security

10.4.5.2 Mobile Security

10.4.5.3 API Security

10.4.6 Historic and Forecasted Market Size by Deployment Mode

10.4.6.1 Cloud

10.4.6.2 On-Premises

10.4.7 Historic and Forecasted Market Size by Organization Size

10.4.7.1 Small and Medium-sized Enterprises (SMEs)

10.4.7.2 Large Enterprises

10.4.8 Historic and Forecasted Market Size by Verticals

10.4.8.1 Retail and eCommerce

10.4.8.2 Media and Entertainment

10.4.8.3 Travel and Tourism

10.4.8.4 BFSI

10.4.8.5 Telecom

10.4.8.6 Government and Defense

10.4.8.7 Healthcare

10.4.8.8 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Bot Security Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Component

10.5.4.1 Standalone Solution

10.5.4.2 Services

10.5.5 Historic and Forecasted Market Size by Security Type

10.5.5.1 Web Security

10.5.5.2 Mobile Security

10.5.5.3 API Security

10.5.6 Historic and Forecasted Market Size by Deployment Mode

10.5.6.1 Cloud

10.5.6.2 On-Premises

10.5.7 Historic and Forecasted Market Size by Organization Size

10.5.7.1 Small and Medium-sized Enterprises (SMEs)

10.5.7.2 Large Enterprises

10.5.8 Historic and Forecasted Market Size by Verticals

10.5.8.1 Retail and eCommerce

10.5.8.2 Media and Entertainment

10.5.8.3 Travel and Tourism

10.5.8.4 BFSI

10.5.8.5 Telecom

10.5.8.6 Government and Defense

10.5.8.7 Healthcare

10.5.8.8 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Bot Security Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Component

10.6.4.1 Standalone Solution

10.6.4.2 Services

10.6.5 Historic and Forecasted Market Size by Security Type

10.6.5.1 Web Security

10.6.5.2 Mobile Security

10.6.5.3 API Security

10.6.6 Historic and Forecasted Market Size by Deployment Mode

10.6.6.1 Cloud

10.6.6.2 On-Premises

10.6.7 Historic and Forecasted Market Size by Organization Size

10.6.7.1 Small and Medium-sized Enterprises (SMEs)

10.6.7.2 Large Enterprises

10.6.8 Historic and Forecasted Market Size by Verticals

10.6.8.1 Retail and eCommerce

10.6.8.2 Media and Entertainment

10.6.8.3 Travel and Tourism

10.6.8.4 BFSI

10.6.8.5 Telecom

10.6.8.6 Government and Defense

10.6.8.7 Healthcare

10.6.8.8 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Bot Security Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Component

10.7.4.1 Standalone Solution

10.7.4.2 Services

10.7.5 Historic and Forecasted Market Size by Security Type

10.7.5.1 Web Security

10.7.5.2 Mobile Security

10.7.5.3 API Security

10.7.6 Historic and Forecasted Market Size by Deployment Mode

10.7.6.1 Cloud

10.7.6.2 On-Premises

10.7.7 Historic and Forecasted Market Size by Organization Size

10.7.7.1 Small and Medium-sized Enterprises (SMEs)

10.7.7.2 Large Enterprises

10.7.8 Historic and Forecasted Market Size by Verticals

10.7.8.1 Retail and eCommerce

10.7.8.2 Media and Entertainment

10.7.8.3 Travel and Tourism

10.7.8.4 BFSI

10.7.8.5 Telecom

10.7.8.6 Government and Defense

10.7.8.7 Healthcare

10.7.8.8 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Q1: What would be the forecast period in the Bot Security Market research report?

A1: The forecast period in the Bot Security Market research report is 2024-2032.

Q2: Who are the key players in the Bot Security Market?

A2: Akamai Technologies, Imperva, PerimeterX, Cloudflare, Radware, Fastly, F5,Sophos, and others

Q3: What are the segments of the Bot Security Market?

A3: The By Component (Standalone Solution, Services), By Security Type (Web Security, Mobile Security, API Security), By Deployment Mode (Cloud, On-Premises), By Organization Size (Small and Medium-sized Enterprises (SMEs), Large Enterprises), By Verticals (Retail and eCommerce, Media and Entertainment, Travel and Tourism, BFSI, Telecom, Government and Defense, Healthcare, Others)and By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Bot Security Market?

A4: Bot security refers to the measures taken to protect against threats posed by automated software applications, commonly known as bots, which can range from benign to malicious. These measures encompass various techniques and technologies aimed at safeguarding systems, networks, and applications from unauthorized access, data theft, fraud, and other cyber threats facilitated by bots. This includes but is not limited to authentication mechanisms, access controls, anomaly detection, bot management solutions, and behavioral analysis to identify and mitigate bot-related risks. Ultimately, bot security seeks to maintain the integrity, confidentiality, and availability of digital assets and resources in the face of evolving bot-based threats.

Q5: How big is the Bot Security Market?

A5: Bot Security Market Size Was Valued at USD 666.7 Million in 2023 and is Projected to Reach USD 3025.5 Million by 2032, Growing at a CAGR of 18.3% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!