Stay Ahead in Fast-Growing Economies.

Browse Reports NowCondominiums and Apartments Market: Report & Growth Highlights

The condominiums and apartments market are a dynamic sector within the real estate industry that caters to diverse housing needs. Both condominiums and apartments are types of multi-unit residential buildings, but they differ in ownership structure. Condominiums are typically individually owned units within a larger complex, with residents collectively owning and managing common areas. In contrast, apartments are often owned and managed by a single entity, and residents rent individual units. In recent years, the market has witnessed significant growth due to urbanization, changing demographics, and a shift in lifestyle preferences.

IMR Group

Description

Condominiums and Apartments Market Synopsis

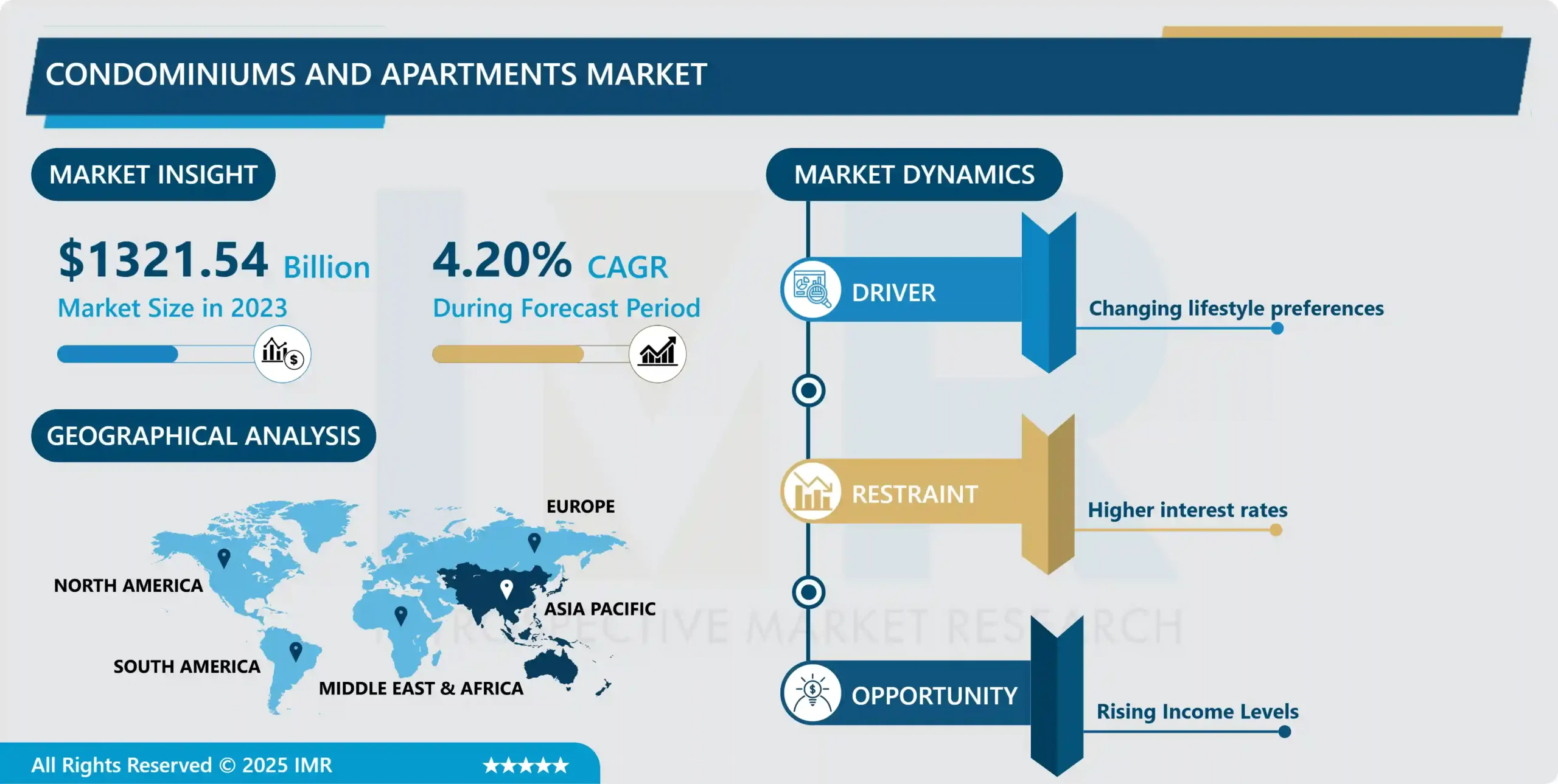

Condominiums and Apartments Market Size Was Valued at USD 1321.54 Billion in 2023, and is Projected to Reach 1686.8 USD Billion by 2032, Growing at a CAGR of 4.2% From 2024-2032.

The condominiums and apartments market are a dynamic sector within the real estate industry that caters to diverse housing needs. Both condominiums and apartments are types of multi-unit residential buildings, but they differ in ownership structure. Condominiums are typically individually owned units within a larger complex, with residents collectively owning and managing common areas. In contrast, apartments are often owned and managed by a single entity, and residents rent individual units.

In recent years, the market has witnessed significant growth due to urbanization, changing demographics, and a shift in lifestyle preferences. The appeal of condominiums lies in the sense of ownership, amenities, and community living, attracting a mix of first-time homebuyers, young professionals, and empty nesters. Apartments, on the other hand, offer flexibility and are popular among those seeking temporary or more affordable housing solutions.

Market trends indicate a growing demand for sustainable and technologically advanced features in both condominiums and apartments. Developers are incorporating green building practices, energy-efficient technologies, and smart home systems to meet the evolving preferences of buyers and renters.

Condominiums and Apartments Market Trend Analysis

Changing lifestyle preferences

Changing lifestyle preferences have become a pivotal driving force in the condominiums and apartments market. In contemporary society, there is a discernible shift towards urban living, driven by a desire for convenience, proximity to amenities, and a dynamic social environment. The younger demographic, in particular, values the flexibility and low-maintenance lifestyle that condominiums and apartments offer.

The modern workforce, characterized by a preference for work-life balance, finds the centralized locations of condominiums and apartments attractive, reducing commute times and providing easy access to entertainment and cultural hubs. Moreover, the increasing trend of smaller households and a growing emphasis on sustainability align with the compact living spaces offered by these properties.

Condominiums, with shared amenities and a sense of community, appeal to those seeking a more connected and communal living experience. Additionally, the rising cost of homeownership and the desire for hassle-free living contribute to the popularity of condominiums and apartments.

Rising Income Levels Creates an Opportunity

Rising income levels present a significant opportunity for the condominiums and apartments market. As individuals experience an increase in disposable income, their purchasing power for real estate, particularly in urban areas, expands. This trend fosters a growing demand for housing options that offer modern amenities, convenience, and a luxurious lifestyle, which condominiums and apartments are well-positioned to provide.

Higher incomes often translate into a desire for improved living standards and a shift towards urban living, where these residential units thrive. Developers can capitalize on this trend by designing and offering upscale condominiums and apartments that cater to the evolving preferences of affluent buyers. These properties may feature state-of-the-art facilities, smart home technologies, and premium services, appealing to individuals seeking a sophisticated and comfortable living experience.

Moreover, the rising income levels contribute to an increased number of first-time homebuyers entering the market, and condominiums, with their relatively lower maintenance requirements, become an attractive option. This creates a vibrant market for real estate developers and investors, fostering growth and innovation within the condominiums and apartments sector as it adapts to meet the changing demands of a wealthier consumer base.

Condominiums and Apartments Market Segment Analysis:

Condominiums and Apartments Market is Segmented into Location, Buyer Demographics, Property Types, Amenities, Investment vs. Residential, Age of Construction.

By Location, Urban segment is expected to dominate the market during the forecast period

In the Condominiums and Apartments Market, the urban segment is anticipated to exert dominance, driven by the increasing trend of urbanization and population concentration in metropolitan areas. Urban locations offer numerous advantages, including proximity to employment opportunities, educational institutions, and cultural amenities, making them highly desirable for residential purposes.

The demand for condominiums and apartments in urban settings is further fueled by the growing need for convenient and compact living spaces, especially among young professionals and individuals seeking a vibrant city lifestyle. Additionally, urban areas often witness higher levels of real estate development and infrastructure investment, contributing to the expansion of the condominium and apartment market. This trend is likely to persist as urbanization continues, shaping the market landscape with a strong emphasis on urban-centric housing solutions.

By Buyer Demographics, First-time Buyers segment held the largest share of 36.4% in 2022

In the Condominiums and Apartments Market, the First-time Buyers segment is poised to dominate buyer demographics. These individuals, typically in their late twenties to mid-thirties, represent a significant portion of the market due to various factors. First-time buyers are often drawn to the condominium and apartment sector due to its affordability compared to single-family homes and the flexibility it offers in terms of location and maintenance.

Additionally, this demographic tends to prioritize convenience, urban living, and access to amenities, all of which are commonly associated with condominium and apartment living. Factors such as increasing urbanization, changing lifestyle preferences, and delayed marriage and homeownership contribute to the growing prominence of first-time buyers in this market segment. Developers and stakeholders in the real estate industry are keenly attuned to the needs and preferences of this demographic, driving innovation and tailored offerings to cater to their demands.

Condominiums and Apartments Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

The Asia Pacific region is poised to assert dominance in the Condominiums and Apartments market, exhibiting a robust and sustained growth trajectory. This ascendancy is underpinned by a confluence of factors, including rapid urbanization, burgeoning populations, and a rising middle class with increasing disposable income. The region’s real estate landscape is undergoing a transformative shift, with a heightened demand for modern and convenient living spaces, especially in key metropolitan areas.

Government initiatives promoting urban development and infrastructure investments further fuel this trend. The Asia Pacific Condominiums and Apartments market is expected to experience unparalleled expansion, offering lucrative opportunities for developers and investors alike. This dominance is characterized by innovative architectural designs, amenities catering to contemporary lifestyles, and a dynamic real estate ecosystem that positions the region at the forefront of global residential property markets.

Condominiums and Apartments Market Top Key Players:

China Vanke Co., Ltd (China)

Evergrande Group (China)

Country Garden Holdings (China)

Mitsubishi Estate Co., Ltd. (Japan)

Mitsui Fudosan Co., Ltd. (Japan)

Sumitomo Realty & Development Co., Ltd. (Japan)

CapitaLand Limited (Singapore)

City Developments Limited (Singapore)

Ayala Land, Inc. (Philippines)

SM Prime Holdings, Inc. (Philippines)

Emaar Properties (United Arab Emirates)

Damac Properties (United Arab Emirates)

Lennar Corporation (United States)

Equity Residential (United States)

AvalonBay Communities, Inc. (United States)

Prologis, Inc. (United States)

Vornado Realty Trust (United States)

Brookfield Asset Management Inc. (Canada)

Concord Pacific (Canada)

Lendlease Corporation Limited (Australia), and Other Major Players.

Key Industry Developments in the Condominiums and Apartments Market:

In January 2023, DB Realty made significant strides in Pune’s real estate market, unveiling three cutting-edge residential projects. The company’s bold venture involved a substantial investment of ?2,500 crore, reinforcing its commitment to transforming the cityscape. The projects are poised to redefine urban living, offering modern amenities and innovative designs. DB Realty’s strategic move aligns with the burgeoning demand for quality housing in Pune, marking a milestone in the real estate sector.

In February 2023, Macrotech Developers revealed a strategic merger with Lodha Developers, a significant move that resulted in the formation of one of India’s largest real estate entities. The consolidation aimed to leverage the strengths of both companies, promising to reshape the real estate landscape in India. The merger marked a pivotal moment in the industry, with heightened expectations for the combined expertise and resources of Macrotech and Lodha.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Condominiums and Apartments Market by Location (2018-2032)

4.1 Condominiums and Apartments Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Urban

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Suburban

4.5 Rural

Chapter 5: Condominiums and Apartments Market by Buyer Demographics (2018-2032)

5.1 Condominiums and Apartments Market Snapshot and Growth Engine

5.2 Market Overview

5.3 First-time Buyers

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Empty Nesters

5.5 Millennials

5.6 Retirees

Chapter 6: Condominiums and Apartments Market by Property Types (2018-2032)

6.1 Condominiums and Apartments Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Luxury Condos

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Affordable Housing

6.5 Mixed-Use Developments

6.6 Student Housing

Chapter 7: Condominiums and Apartments Market by Amenities (2018-2032)

7.1 Condominiums and Apartments Market Snapshot and Growth Engine

7.2 Market Overview

7.3 High-rise vs. Low-rise

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Gated Communities

7.5 Fitness-Centric

7.6 Green Buildings

Chapter 8: Condominiums and Apartments Market by Investment vs. Residential (2018-2032)

8.1 Condominiums and Apartments Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Investment Properties

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Owner-Occupied

Chapter 9: Condominiums and Apartments Market by Age of Construction (2018-2032)

9.1 Condominiums and Apartments Market Snapshot and Growth Engine

9.2 Market Overview

9.3 New Developments

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Established Communities

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Condominiums and Apartments Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 SEALED AIR CORPORATION (UNITED STATES)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 BASF SE (GERMANY)

10.4 ZOTEFOAMS PLC (UNITED KINGDOM)

10.5 RECTICEL NV/SA (BELGIUM)

10.6 FOAMPARTNER GROUP (SWITZERLAND)

10.7 ROGERS CORPORATION (UNITED STATES)

10.8 WOODBRIDGE FOAM CORPORATION (CANADA)

10.9 FXI INC. (UNITED STATES)

10.10 UFP TECHNOLOGIES INC. (UNITED STATES)

10.11 VITA GROUP (UNITED KINGDOM)

10.12 FUTURE FOAM INC. (UNITED STATES)

10.13 ARMACELL LLC (LUXEMBOURG)

10.14 THE DOW CHEMICAL COMPANY (UNITED STATES)

10.15 INOAC CORPORATION (JAPAN)

10.16 SEKISUI ALVEO AG (SWITZERLAND)

10.17 CARPENTER CO. (UNITED STATES)

10.18 CREST FOAM INDUSTRIES INC. (UNITED STATES)

10.19 EUROFOAM GROUP (AUSTRIA)

10.20 VITA CELLULAR FOAMS (INDIA)

10.21 WANHUA CHEMICAL GROUP COLTD. (CHINA)

10.22 HUNTSMAN CORPORATION (UNITED STATES)

10.23 JSP CORPORATION (JAPAN)

10.24 SSW PEARLFOAM GMBH (GERMANY)

10.25 FXI-FOAMEX INNOVATIONS (UNITED STATES)

10.26 EVONIK INDUSTRIES AG (GERMANY)

10.27

Chapter 11: Global Condominiums and Apartments Market By Region

11.1 Overview

11.2. North America Condominiums and Apartments Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size by Location

11.2.4.1 Urban

11.2.4.2 Suburban

11.2.4.3 Rural

11.2.5 Historic and Forecasted Market Size by Buyer Demographics

11.2.5.1 First-time Buyers

11.2.5.2 Empty Nesters

11.2.5.3 Millennials

11.2.5.4 Retirees

11.2.6 Historic and Forecasted Market Size by Property Types

11.2.6.1 Luxury Condos

11.2.6.2 Affordable Housing

11.2.6.3 Mixed-Use Developments

11.2.6.4 Student Housing

11.2.7 Historic and Forecasted Market Size by Amenities

11.2.7.1 High-rise vs. Low-rise

11.2.7.2 Gated Communities

11.2.7.3 Fitness-Centric

11.2.7.4 Green Buildings

11.2.8 Historic and Forecasted Market Size by Investment vs. Residential

11.2.8.1 Investment Properties

11.2.8.2 Owner-Occupied

11.2.9 Historic and Forecasted Market Size by Age of Construction

11.2.9.1 New Developments

11.2.9.2 Established Communities

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Condominiums and Apartments Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size by Location

11.3.4.1 Urban

11.3.4.2 Suburban

11.3.4.3 Rural

11.3.5 Historic and Forecasted Market Size by Buyer Demographics

11.3.5.1 First-time Buyers

11.3.5.2 Empty Nesters

11.3.5.3 Millennials

11.3.5.4 Retirees

11.3.6 Historic and Forecasted Market Size by Property Types

11.3.6.1 Luxury Condos

11.3.6.2 Affordable Housing

11.3.6.3 Mixed-Use Developments

11.3.6.4 Student Housing

11.3.7 Historic and Forecasted Market Size by Amenities

11.3.7.1 High-rise vs. Low-rise

11.3.7.2 Gated Communities

11.3.7.3 Fitness-Centric

11.3.7.4 Green Buildings

11.3.8 Historic and Forecasted Market Size by Investment vs. Residential

11.3.8.1 Investment Properties

11.3.8.2 Owner-Occupied

11.3.9 Historic and Forecasted Market Size by Age of Construction

11.3.9.1 New Developments

11.3.9.2 Established Communities

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Condominiums and Apartments Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size by Location

11.4.4.1 Urban

11.4.4.2 Suburban

11.4.4.3 Rural

11.4.5 Historic and Forecasted Market Size by Buyer Demographics

11.4.5.1 First-time Buyers

11.4.5.2 Empty Nesters

11.4.5.3 Millennials

11.4.5.4 Retirees

11.4.6 Historic and Forecasted Market Size by Property Types

11.4.6.1 Luxury Condos

11.4.6.2 Affordable Housing

11.4.6.3 Mixed-Use Developments

11.4.6.4 Student Housing

11.4.7 Historic and Forecasted Market Size by Amenities

11.4.7.1 High-rise vs. Low-rise

11.4.7.2 Gated Communities

11.4.7.3 Fitness-Centric

11.4.7.4 Green Buildings

11.4.8 Historic and Forecasted Market Size by Investment vs. Residential

11.4.8.1 Investment Properties

11.4.8.2 Owner-Occupied

11.4.9 Historic and Forecasted Market Size by Age of Construction

11.4.9.1 New Developments

11.4.9.2 Established Communities

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Condominiums and Apartments Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size by Location

11.5.4.1 Urban

11.5.4.2 Suburban

11.5.4.3 Rural

11.5.5 Historic and Forecasted Market Size by Buyer Demographics

11.5.5.1 First-time Buyers

11.5.5.2 Empty Nesters

11.5.5.3 Millennials

11.5.5.4 Retirees

11.5.6 Historic and Forecasted Market Size by Property Types

11.5.6.1 Luxury Condos

11.5.6.2 Affordable Housing

11.5.6.3 Mixed-Use Developments

11.5.6.4 Student Housing

11.5.7 Historic and Forecasted Market Size by Amenities

11.5.7.1 High-rise vs. Low-rise

11.5.7.2 Gated Communities

11.5.7.3 Fitness-Centric

11.5.7.4 Green Buildings

11.5.8 Historic and Forecasted Market Size by Investment vs. Residential

11.5.8.1 Investment Properties

11.5.8.2 Owner-Occupied

11.5.9 Historic and Forecasted Market Size by Age of Construction

11.5.9.1 New Developments

11.5.9.2 Established Communities

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Condominiums and Apartments Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size by Location

11.6.4.1 Urban

11.6.4.2 Suburban

11.6.4.3 Rural

11.6.5 Historic and Forecasted Market Size by Buyer Demographics

11.6.5.1 First-time Buyers

11.6.5.2 Empty Nesters

11.6.5.3 Millennials

11.6.5.4 Retirees

11.6.6 Historic and Forecasted Market Size by Property Types

11.6.6.1 Luxury Condos

11.6.6.2 Affordable Housing

11.6.6.3 Mixed-Use Developments

11.6.6.4 Student Housing

11.6.7 Historic and Forecasted Market Size by Amenities

11.6.7.1 High-rise vs. Low-rise

11.6.7.2 Gated Communities

11.6.7.3 Fitness-Centric

11.6.7.4 Green Buildings

11.6.8 Historic and Forecasted Market Size by Investment vs. Residential

11.6.8.1 Investment Properties

11.6.8.2 Owner-Occupied

11.6.9 Historic and Forecasted Market Size by Age of Construction

11.6.9.1 New Developments

11.6.9.2 Established Communities

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Condominiums and Apartments Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size by Location

11.7.4.1 Urban

11.7.4.2 Suburban

11.7.4.3 Rural

11.7.5 Historic and Forecasted Market Size by Buyer Demographics

11.7.5.1 First-time Buyers

11.7.5.2 Empty Nesters

11.7.5.3 Millennials

11.7.5.4 Retirees

11.7.6 Historic and Forecasted Market Size by Property Types

11.7.6.1 Luxury Condos

11.7.6.2 Affordable Housing

11.7.6.3 Mixed-Use Developments

11.7.6.4 Student Housing

11.7.7 Historic and Forecasted Market Size by Amenities

11.7.7.1 High-rise vs. Low-rise

11.7.7.2 Gated Communities

11.7.7.3 Fitness-Centric

11.7.7.4 Green Buildings

11.7.8 Historic and Forecasted Market Size by Investment vs. Residential

11.7.8.1 Investment Properties

11.7.8.2 Owner-Occupied

11.7.9 Historic and Forecasted Market Size by Age of Construction

11.7.9.1 New Developments

11.7.9.2 Established Communities

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

Q1: What would be the forecast period in the Condominiums and Apartments Market research report?

A1: The forecast period in the Condominiums and Apartments Market research report is 2024-2032.

Q2: Who are the key players in the Condominiums and Apartments Market?

A2: China Vanke Co., Ltd (China), Evergrande Group (China), Country Garden Holdings (China), Mitsubishi Estate Co., Ltd. (Japan), Mitsui Fudosan Co., Ltd. (Japan), Sumitomo Realty & Development Co., Ltd. (Japan), CapitaLand Limited (Singapore), City Developments Limited (Singapore), Ayala Land, Inc. (Philippines), SM Prime Holdings, Inc. (Philippines), Emaar Properties (United Arab Emirates), Damac Properties (United Arab Emirates), Lennar Corporation (United States), Equity Residential (United States), AvalonBay Communities, Inc. (United States), Prologis, Inc. (United States), Vornado Realty Trust (United States), Brookfield Asset Management Inc. (Canada), Concord Pacific (Canada), Lendlease Corporation Limited (Australia), and Other Major Players.

Q3: What are the segments of the Condominiums and Apartments Market?

A3: Condominiums and Apartments Market is segmented into Product, Material Type, Application and region. By Location the market is categorized into (Urban, Suburban, Rural), By Buyer Demographics the market is categorized into (First-time Buyers, Empty Nesters, Millennials, Retirees), By Property Types the market is categorized into (Luxury Condos, Affordable Housing, Mixed-Use Developments, Student Housing), By Amenities the market is categorized into (High-rise vs. Low-rise, Gated Communities, Fitness-Centric, Green Buildings), By Investment vs. Residential the market is categorized into (Investment Properties, Owner-Occupied), By Age of Construction the market is categorized into (New Developments, Established Communities),. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Condominiums and Apartments Market?

A4: Condominiums are typically individually owned units within a larger complex, with residents collectively owning and managing common areas. In contrast, apartments are often owned and managed by a single entity, and residents rent individual units.

Q5: How big is the Condominiums and Apartments Market?

A5: Condominiums and Apartments Market Size Was Valued at USD 1321.54 Billion in 2023, and is Projected to Reach 1686.8 USD Billion by 2032, Growing at a CAGR of 4.2% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!