Stay Ahead in Fast-Growing Economies.

Browse Reports NowClinical Trial Outsourcing Market- In-Deep Analysis Focusing on Market Share

Clinical trial outsourcing refers to the practice where pharmaceutical, biotechnology, or medical device companies collaborate with Contract Research Organizations (CROs) or other specialized service providers to delegate various aspects of the clinical trial process.

IMR Group

Description

Global Clinical Trial Outsourcing Market Synopsis

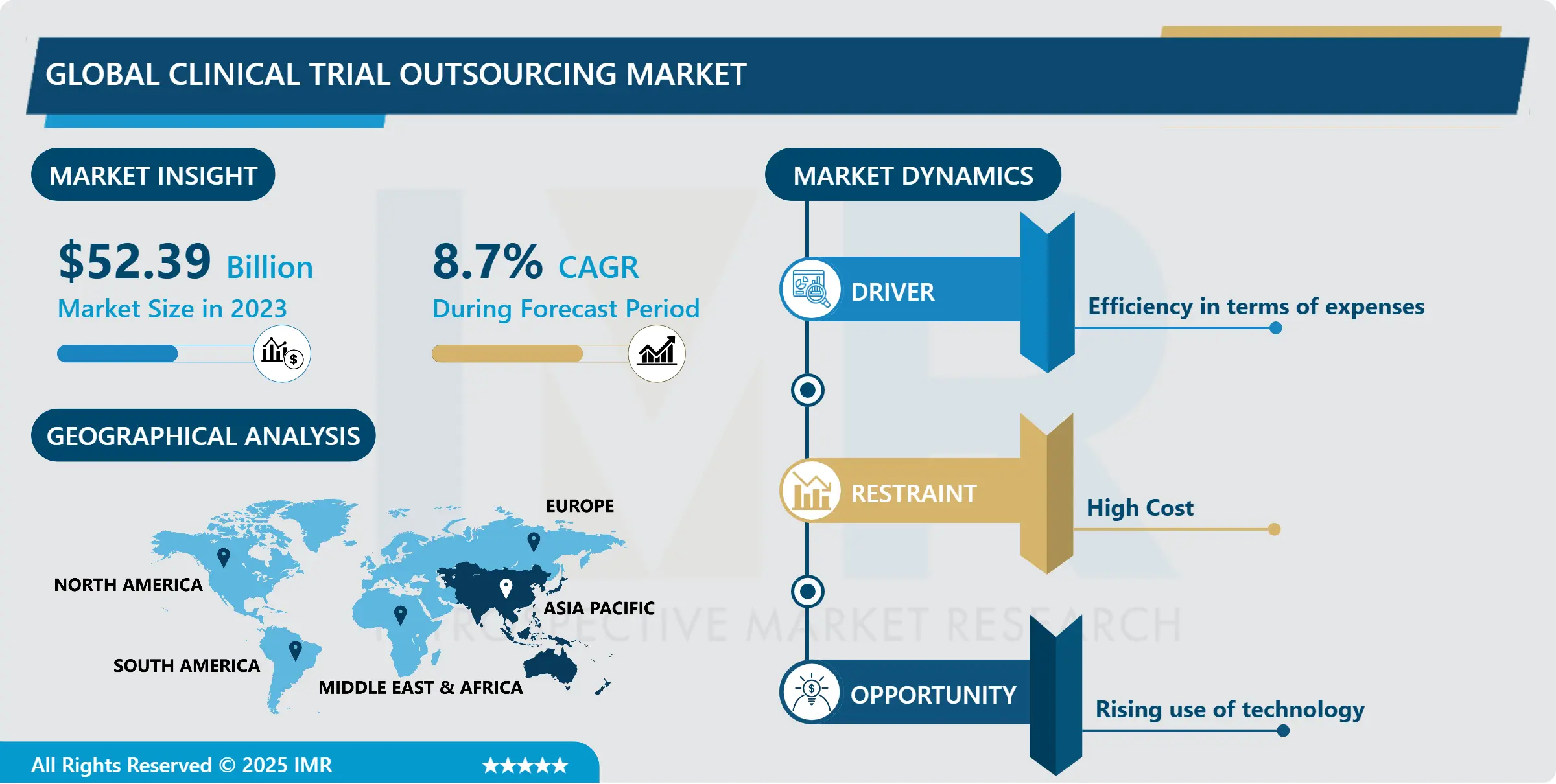

Global Clinical Trial Outsourcing Market Size Was Valued at USD 52.39 Billion in 2023, and is Projected to Reach USD 111.01 Billion by 2032, Growing at a CAGR of 8.7% From 2024-2032.

Clinical trial outsourcing refers to the practice where pharmaceutical, biotechnology, or medical device companies collaborate with Contract Research Organizations (CROs) or other specialized service providers to delegate various aspects of the clinical trial process. The clinical trial outsourcing market has experienced significant growth and evolution in recent years due to various factors reshaping the pharmaceutical and biotechnology industries. Outsourcing clinical trials has become increasingly prevalent as companies seek to streamline operations, reduce costs, and access specialized expertise. This market’s growth is propelled by the rising complexity of clinical trials, advancements in technology, and the global expansion of research and development activities.

The market is witnessing a shift toward strategic partnerships and collaborations between pharmaceutical companies and Contract Research Organizations (CROs). These partnerships allow for efficient resource utilization, increased flexibility, and access to a broader range of services and expertise. Moreover, the demand for specialized services such as clinical data management, regulatory affairs, and biostatistics has fuelled the growth of niche CROs catering to specific therapeutic areas or phases of clinical trials.

Clinical Trial Outsourcing Market Trend Analysis:

Increasing Drugs in The Pipeline and Rising Investments in Pharmaceutical R&D

The pharmaceutical industry has experienced a surge in drug development initiatives and a substantial uptick in investments dedicated to research and development (R&D). This growth can be attributed to several factors, including advancements in scientific understanding, technological innovations, and an evolving regulatory landscape. One significant driver is the pressing need to address unmet medical needs and combat complex diseases that continue to pose significant challenges globally.

The emergence of ground-breaking technologies, such as genomics, precision medicine, and biotechnology, has accelerated the drug discovery process. This has led to an expansion in the number of potential drug candidates in the pipeline. The ability to delve deeper into the genetic and molecular basis of diseases has opened new avenues for developing targeted therapies, leading to a heightened enthusiasm for R&D investments across the pharmaceutical sector.

Parallelly, the convergence of diverse disciplines, including artificial intelligence (AI), machine learning, and big data analytics, has revolutionized the way researchers explore and identify potential drug targets. These tools enable efficient screening of compounds, predictive modeling of drug interactions, and optimization of clinical trial designs, significantly reducing the time and resources required for drug development.

Favorable Outlook for Biologics and Biosimilars

The burgeoning market for biologics and biosimilars presents a significant opportunity within the realm of clinical trial outsourcing. Biologics, derived from living organisms, offer innovative therapeutic options for various complex diseases, driving a surge in their development. Simultaneously, the increasing interest in biosimilars, which are highly similar versions of approved biologic products, presents a cost-effective alternative and fosters competition in the market.

The complex nature of biologics demands specialized expertise and rigorous testing, creating a robust demand for outsourced clinical trials. Contract Research Organizations (CROs) equipped with expertise in handling the intricacies of biological compounds are increasingly sought after by pharmaceutical companies aiming to navigate the complexities of these trials effectively. From design and manufacturing to clinical testing and regulatory compliance, outsourcing allows companies to tap into specialized knowledge and resources required for successful biologic development.

Clinical Trial Outsourcing Market Segment Analysis:

Clinical Trial Outsourcing Market Segmented on the basis of phase, service type, therapeutic area, and application.

By Phase, Phase III segment is expected to dominate the market during the forecast period

The dominance of the Phase III segment within the clinical trial outsourcing market during the forecast period signifies a critical stage in drug development where outsourced trials play a pivotal role. Phase III trials are the culmination of extensive preclinical and Phase I/II studies, focusing on assessing the efficacy and safety of a drug candidate in a larger patient population. This phase often involves a substantial number of participants across multiple sites, demanding extensive resources, expertise, and efficient management, which drives the reliance on outsourcing.

The complexity and scale of Phase III trials necessitate collaboration with Contract Research Organizations (CROs) possessing a wide array of capabilities, including patient recruitment strategies, diverse geographic reach, regulatory expertise, and data management proficiency.

By Service Type, Analytical Testing Services segment held the largest share of 31.6% in 2022

Analytical testing services encompass a wide spectrum of activities, including chemical, physical, and biological analyses of drug compounds, formulations, and final products. This segment’s significance lies in its contribution to meeting stringent regulatory standards and confirming the integrity and consistency of therapeutic agents.

Pharmaceutical companies increasingly rely on outsourcing analytical testing services to specialized Contract Research Organizations (CROs) equipped with state-of-the-art laboratories and expertise in various analytical techniques

By Therapeutic Area, Oncology segment held the largest share of 35% in 2022

Oncology stands as a leading therapeutic area due to the complex nature of cancer and the continuous quest for more effective treatments. The high prevalence of various cancer types globally has propelled pharmaceutical companies to intensify their focus on developing innovative oncology drugs, fostering a strong demand for outsourced clinical trials.

Therapies are tailored to specific genetic profiles or molecular characteristics of tumors, adding another layer of complexity to clinical trials. This trend has further fuelled the reliance on outsourcing, as specialized CROs possess the expertise to design and execute trials

By Application, Monoclonal Antibodies segment held the largest share of 29% in 2022

Monoclonal antibodies, engineered to target specific antigens, have gained immense traction in treating conditions such as cancer, autoimmune disorders, and infectious diseases. This prominence in clinical trial outsourcing reflects the industry’s emphasis on developing and refining mAbs as a cornerstone of modern therapeutic interventions.

The complex development process and diverse applications of monoclonal antibodies necessitate specialized expertise, driving pharmaceutical companies to outsource these trials to Contract Research Organizations (CROs) equipped with advanced capabilities in biologics development.

Clinical Trial Outsourcing Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

The United States, in particular, leads in clinical research and outsourcing activities, attracting a significant portion of global clinical trials across various therapeutic areas. It boasts a wealth of expertise in advanced technologies, a large pool of skilled professionals, and a conducive environment for conducting trials efficiently.

Clinical Trial Outsourcing Market Top Key Players:

PAREXEL (US)

IQVIA (US)

SYNEOS HEALTH (US)

ICON PLC(US)

MEDIDATA SOLUTIONS (US)

PRA HEALTH SCIENCES (US)

COVANCE (US)

CHARLES RIVER LABORATORIES (US)

CATALENT (US)

EMMES COMPANY (US)

SYNEOS HEALTH (US)

FORTREA INC. (US)

ADVANCED CLINICAL (US)

THERMO FISHER SCIENTIFIC INC. (US)

FRONTAGE LABS (US)

ACM GLOBAL LABORATORIES (US)

WORLDWIDE CLINICAL TRIALS (US)

CTI CLINICAL TRIAL & CONSULTING (US)

FIRMA CLINICAL RESEARCH (US)

CELERION (US)

BOEHRINGER INGELHEIM INTERNATIONAL GMBH (EUROPE)

PHARMASERV INTERNATIONAL (GERMANY)

APTIV SOLUTIONS (FRANCE)

DOVE QUALITY SOLUTIONS (UK)

CLINIGEN GROUP (UK)

Key Industry Developments in the Clinical Trial Outsourcing Market:

In March 2023, Syneos Health entered into a multiyear agreement with Microsoft to create a platform that uses machine learning to elevate biopharma companies’ commercial performance and speed up clinical trial analysis, planning, and operation.

In September 2022, Parexel International established a new clinical trial supplies and logistics facility in Suzhou, China. This facility provides both local and international biopharmaceutical clients with quick access to clinical trial materials and medications for sites and patients, thus expediting the progress of clinical trials in the region.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Clinical Trial Outsourcing Market by Phase (2018-2032)

4.1 Clinical Trial Outsourcing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Phase I

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Phase II

4.5 Phase III

4.6 Phase II

4.7 Phase IV

Chapter 5: Clinical Trial Outsourcing Market by Service Type (2018-2032)

5.1 Clinical Trial Outsourcing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Laboratory Services

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Bioanalytical Testing Services

5.5 Decentralized Clinical Trial Services

5.6 Analytical Testing Services

Chapter 6: Clinical Trial Outsourcing Market by Therapeutic Area (2018-2032)

6.1 Clinical Trial Outsourcing Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Oncology

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Infectious Diseases

6.5 Neurology

6.6 Metabolic

6.7 Disorders

6.8 Immunology

Chapter 7: Clinical Trial Outsourcing Market by Application (2018-2032)

7.1 Clinical Trial Outsourcing Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Small Molecules

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Monoclonal Antibodies

7.5 Vaccine

7.6 Cell & Gene Therapy.

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Clinical Trial Outsourcing Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ACE PAPER TUBE (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 NAGEL PAPER (US)

8.4 SONOCO PRODUCTS COMPANY (US)

8.5 PTS MANUFACTURING CO (US)

8.6 VALK INDUSTRIES INC. (US)

8.7 WESTERN CONTAINER CORP. (US)

8.8 CHICAGO MAILING TUBE (US)

8.9 PAPER TUBES & SALES (US)

8.10 CROWN HOLDINGS INC (US)

8.11 SILGAN HOLDINGS INC (US)

8.12 ARDAGH GROUP (LUXEMBOURG)

8.13 CANFAB PACKAGING INC(CANADA)

8.14 MONDI (UK)

8.15 SAFEPACK INDUSTRIES LTD(INDIA)

8.16 ECO CANISTER (INDIA)

8.17 APL TECHNOPACK (INDIA)

8.18 THE TIN FACTORY (INDIA)

8.19 ECOPACK SOLUTIONS (INDIA)

8.20 STARRIDE PAPER TUBE PVT. LTD. (INDIA)

8.21 AMCOR PLC (AUSTRALIA)

8.22 IRWIN PACKAGING (AUSTRALIA)

8.23 COREX GROUP (BELGIUM)

8.24 SMURFIT KAPPA (DUBLIN)

8.25 KUNERT GRUPPE (GERMANY)

8.26 CAN PACK S.A(POLAND)

Chapter 9: Global Clinical Trial Outsourcing Market By Region

9.1 Overview

9.2. North America Clinical Trial Outsourcing Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Phase

9.2.4.1 Phase I

9.2.4.2 Phase II

9.2.4.3 Phase III

9.2.4.4 Phase II

9.2.4.5 Phase IV

9.2.5 Historic and Forecasted Market Size by Service Type

9.2.5.1 Laboratory Services

9.2.5.2 Bioanalytical Testing Services

9.2.5.3 Decentralized Clinical Trial Services

9.2.5.4 Analytical Testing Services

9.2.6 Historic and Forecasted Market Size by Therapeutic Area

9.2.6.1 Oncology

9.2.6.2 Infectious Diseases

9.2.6.3 Neurology

9.2.6.4 Metabolic

9.2.6.5 Disorders

9.2.6.6 Immunology

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 Small Molecules

9.2.7.2 Monoclonal Antibodies

9.2.7.3 Vaccine

9.2.7.4 Cell & Gene Therapy.

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Clinical Trial Outsourcing Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Phase

9.3.4.1 Phase I

9.3.4.2 Phase II

9.3.4.3 Phase III

9.3.4.4 Phase II

9.3.4.5 Phase IV

9.3.5 Historic and Forecasted Market Size by Service Type

9.3.5.1 Laboratory Services

9.3.5.2 Bioanalytical Testing Services

9.3.5.3 Decentralized Clinical Trial Services

9.3.5.4 Analytical Testing Services

9.3.6 Historic and Forecasted Market Size by Therapeutic Area

9.3.6.1 Oncology

9.3.6.2 Infectious Diseases

9.3.6.3 Neurology

9.3.6.4 Metabolic

9.3.6.5 Disorders

9.3.6.6 Immunology

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 Small Molecules

9.3.7.2 Monoclonal Antibodies

9.3.7.3 Vaccine

9.3.7.4 Cell & Gene Therapy.

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Clinical Trial Outsourcing Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Phase

9.4.4.1 Phase I

9.4.4.2 Phase II

9.4.4.3 Phase III

9.4.4.4 Phase II

9.4.4.5 Phase IV

9.4.5 Historic and Forecasted Market Size by Service Type

9.4.5.1 Laboratory Services

9.4.5.2 Bioanalytical Testing Services

9.4.5.3 Decentralized Clinical Trial Services

9.4.5.4 Analytical Testing Services

9.4.6 Historic and Forecasted Market Size by Therapeutic Area

9.4.6.1 Oncology

9.4.6.2 Infectious Diseases

9.4.6.3 Neurology

9.4.6.4 Metabolic

9.4.6.5 Disorders

9.4.6.6 Immunology

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 Small Molecules

9.4.7.2 Monoclonal Antibodies

9.4.7.3 Vaccine

9.4.7.4 Cell & Gene Therapy.

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Clinical Trial Outsourcing Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Phase

9.5.4.1 Phase I

9.5.4.2 Phase II

9.5.4.3 Phase III

9.5.4.4 Phase II

9.5.4.5 Phase IV

9.5.5 Historic and Forecasted Market Size by Service Type

9.5.5.1 Laboratory Services

9.5.5.2 Bioanalytical Testing Services

9.5.5.3 Decentralized Clinical Trial Services

9.5.5.4 Analytical Testing Services

9.5.6 Historic and Forecasted Market Size by Therapeutic Area

9.5.6.1 Oncology

9.5.6.2 Infectious Diseases

9.5.6.3 Neurology

9.5.6.4 Metabolic

9.5.6.5 Disorders

9.5.6.6 Immunology

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 Small Molecules

9.5.7.2 Monoclonal Antibodies

9.5.7.3 Vaccine

9.5.7.4 Cell & Gene Therapy.

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Clinical Trial Outsourcing Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Phase

9.6.4.1 Phase I

9.6.4.2 Phase II

9.6.4.3 Phase III

9.6.4.4 Phase II

9.6.4.5 Phase IV

9.6.5 Historic and Forecasted Market Size by Service Type

9.6.5.1 Laboratory Services

9.6.5.2 Bioanalytical Testing Services

9.6.5.3 Decentralized Clinical Trial Services

9.6.5.4 Analytical Testing Services

9.6.6 Historic and Forecasted Market Size by Therapeutic Area

9.6.6.1 Oncology

9.6.6.2 Infectious Diseases

9.6.6.3 Neurology

9.6.6.4 Metabolic

9.6.6.5 Disorders

9.6.6.6 Immunology

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 Small Molecules

9.6.7.2 Monoclonal Antibodies

9.6.7.3 Vaccine

9.6.7.4 Cell & Gene Therapy.

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Clinical Trial Outsourcing Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Phase

9.7.4.1 Phase I

9.7.4.2 Phase II

9.7.4.3 Phase III

9.7.4.4 Phase II

9.7.4.5 Phase IV

9.7.5 Historic and Forecasted Market Size by Service Type

9.7.5.1 Laboratory Services

9.7.5.2 Bioanalytical Testing Services

9.7.5.3 Decentralized Clinical Trial Services

9.7.5.4 Analytical Testing Services

9.7.6 Historic and Forecasted Market Size by Therapeutic Area

9.7.6.1 Oncology

9.7.6.2 Infectious Diseases

9.7.6.3 Neurology

9.7.6.4 Metabolic

9.7.6.5 Disorders

9.7.6.6 Immunology

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 Small Molecules

9.7.7.2 Monoclonal Antibodies

9.7.7.3 Vaccine

9.7.7.4 Cell & Gene Therapy.

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Q1: What would be the forecast period in the Clinical Trial Outsourcing Market research report?

A1: The forecast period in the Clinical Trial Outsourcing Market research report is 2024-2032.

Q2: Who are the key players in the Clinical Trial Outsourcing Market?

A2: Parexel (US), IQVIA (US), Syneos Health (US), ICON plc (US), Medidata Solutions (US), PRA Health Sciences (US), Covance (US), Charles River Laboratories (US), Catalent (US), Emmes Company (US), Syneos Health (US), Fortrea Inc. (US), Advanced Clinical (US), Thermo Fisher Scientific Inc. (US), Frontage Labs (US), ACM Global Laboratories (US), Worldwide Clinical Trials (US), CTI Clinical Trial & Consulting (US), Firma Clinical Research (US), Celerion (US), Boehringer Ingelheim International GmbH (Europe), Pharmaserv International (Germany), Aptiv Solutions (France), Dove Quality Solutions (UK), Clinigen Group (UK), and Other Major Players.

Q3: What are the segments of the Clinical Trial Outsourcing Market?

A3: The Clinical Trial Outsourcing Market is segmented into Phase, Service Type, Therapeutic Area, Application, and region. By Phase, the market is categorized into Phase I, Phase II, Phase III, and Phase IV. By Service Type, the market is categorized into Laboratory Services, Bioanalytical Testing Services, Decentralized Clinical Trial Services, and Analytical Testing Services. By Therapeutic Area, the market is categorized into Oncology, Infectious Diseases, Neurology, Metabolic, Disorders, and Immunology. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Clinical Trial Outsourcing Market?

A4: Clinical trial outsourcing refers to the practice where pharmaceutical, biotechnology, or medical device companies collaborate with Contract Research Organizations (CROs) or other specialized service providers to delegate various aspects of the clinical trial process.

Q5: How big is the Clinical Trial Outsourcing Market?

A5: Global Clinical Trial Outsourcing Market Size Was Valued at USD 52.39 Billion in 2023, and is Projected to Reach USD 111.01 Billion by 2032, Growing at a CAGR of 8.7% From 2024-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!