Stay Ahead in Fast-Growing Economies.

Browse Reports NowSustainable Pharmaceutical Packaging Market – Size And Share

The sustainable pharmaceutical packaging market refers to the segment of the pharmaceutical industry that focuses on creating environmentally friendly and socially responsible packaging solutions for pharmaceutical products.

IMR Group

Description

Sustainable Pharmaceutical Packaging Market Synopsis

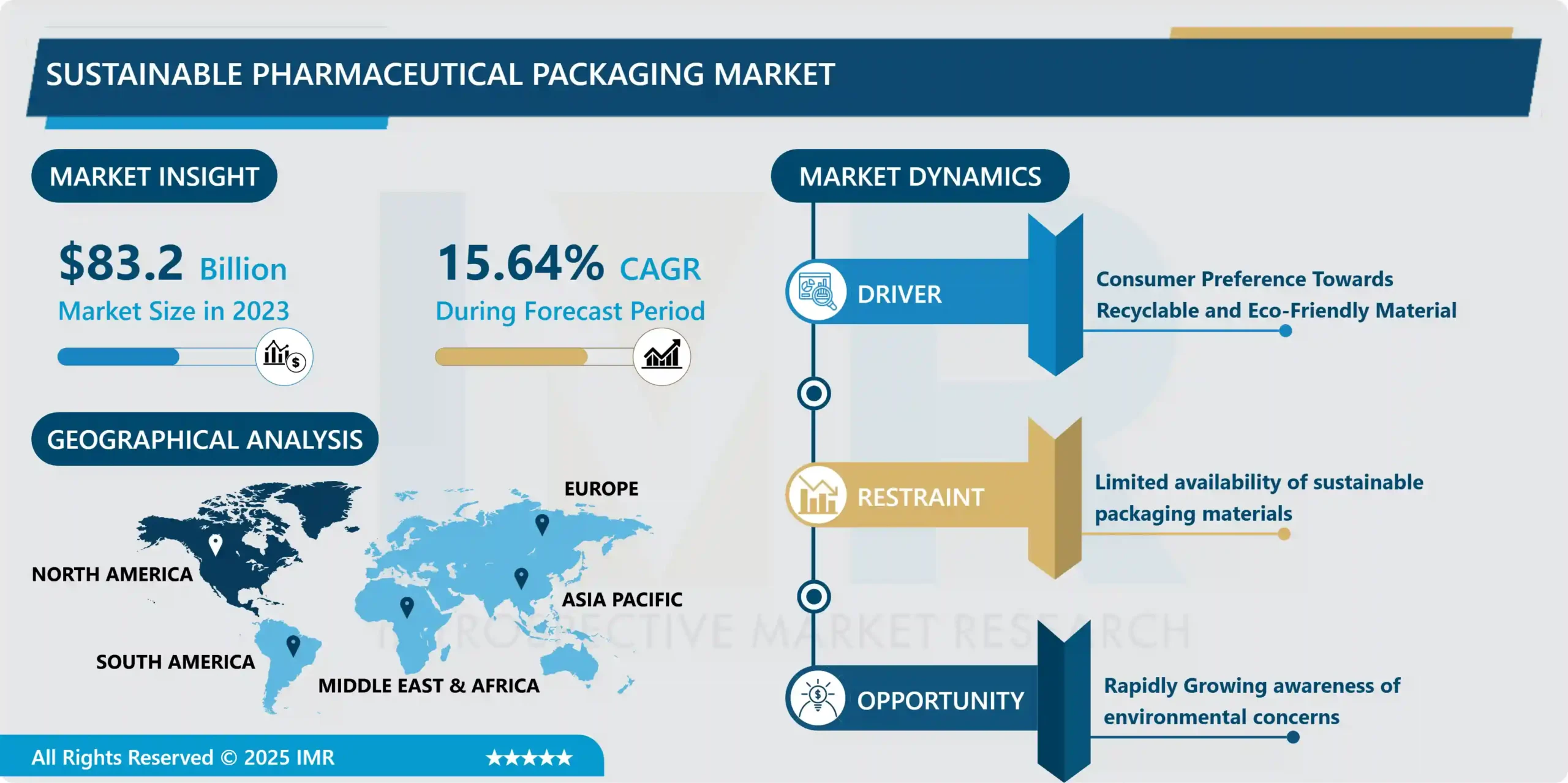

Sustainable Pharmaceutical Packaging Market size was valued at USD 83.2 billion in 2023 and is projected to reach USD 307.68 billion by 2032, growing at a CAGR of 15.64% from 2024 to 2032.

The sustainable pharmaceutical packaging market refers to the segment of the pharmaceutical industry that focuses on creating environmentally friendly and socially responsible packaging solutions for pharmaceutical products.

This market has emerged in response to growing concerns about the environmental impact of traditional packaging materials, such as plastic, and the pharmaceutical industry’s commitment to reducing its carbon footprint. Sustainable pharmaceutical packaging aims to minimize waste, reduce energy consumption, and promote the use of recyclable and biodegradable materials in packaging design.

There has been a significant growth in consumer preferences and regulatory requirements towards sustainable packaging solutions. Pharmaceutical companies are increasingly adopting eco-friendly packaging practices to meet these demands and enhance their brand image. Sustainable pharmaceutical packaging may include the use of recycled materials, reduced packaging size and weight, and innovative designs that minimize the need for excess packaging.

The sustainable pharmaceutical packaging market represents a Crucial transformation in the pharmaceutical industry towards more responsible and eco-conscious practices. It reflects the industry’s commitment to reducing its environmental footprint and addressing societal concerns about plastic waste and pollution. As consumers become more environmentally conscious and governments enact stricter regulations, the adoption of sustainable pharmaceutical packaging is expected to continue to grow, driving innovation and fostering a more sustainable future for the pharmaceutical sector. This market not only benefits the environment but also aligns with the industry’s broader goals of improving public health and well-being.

The Sustainable Pharmaceutical Packaging Market Trend Analysis

Growing Health Care Industry

The healthcare industry is experiencing an unprecedented growth in demand for pharmaceutical products. With an aging population, increasing prevalence of chronic diseases, and global healthcare advancements, the need for medications and medical supplies is on the rise. This surge in demand directly translates into a greater requirement for pharmaceutical packaging. Sustainable packaging solutions become essential in meeting this demand while minimizing the environmental impact.

Governments and regulatory bodies worldwide are increasingly emphasizing sustainability in pharmaceutical packaging. They are imposing stringent environmental regulations to curb plastic waste, reduce carbon emissions, and promote recycling. This regulatory pressure forces pharmaceutical companies to adopt sustainable packaging options to remain compliant and avoid fines or sanctions. many pharmaceutical companies are actively seeking eco-friendly packaging alternatives to align with these regulations and reduce their carbon footprint.

Patients and healthcare providers are becoming more conscious of the environmental impact of pharmaceutical products, including their packaging. Pharmaceutical companies that embrace sustainable packaging can enhance their brand image, attract environmentally conscious consumers, and build long-term loyalty. This shift in consumer preferences is driving pharmaceutical companies to invest in eco-friendly packaging materials and practices to stay competitive in the market.

The growing healthcare industry has led to a higher demand for pharmaceutical products, resulting in a greater need for sustainable packaging solutions to meet environmental and regulatory requirements.

Rapidly Growing awareness of environmental concerns

The pharmaceutical industry is under increasing pressure to adopt sustainable practices. Traditional pharmaceutical packaging, often reliant on single-use plastics and energy-intensive manufacturing processes, has been a significant contributor to environmental degradation. This has led to the emergence of the sustainable pharmaceutical packaging market, which seeks to address these issues. Sustainable packaging options include biodegradable materials, recyclable packaging, reduced energy consumption during production, and innovative designs that minimize waste. Moreover, sustainable pharmaceutical packaging extends beyond materials to encompass responsible sourcing, efficient distribution, and end-of-life considerations.

Rapidly growing awareness of environmental concerns has been a driving force behind the expansion of this market. Consumers and regulatory bodies are increasingly demanding eco-friendly alternatives in pharmaceutical packaging, prompting pharmaceutical companies to re-evaluate their packaging strategies. Furthermore, sustainability in pharmaceutical packaging not only aligns with corporate social responsibility goals but also presents opportunities for cost reduction through improved supply chain efficiency and reduced waste disposal costs. As a result, the industry is witnessing a shift towards sustainable practices and a growing demand for environmentally responsible packaging solutions.

The Sustainable Pharmaceutical Packaging Market represents a crucial response to the pressing environmental issues associated with traditional pharmaceutical packaging. With the global awareness of environmental concerns on the rise, pharmaceutical companies are recognizing the need to adopt sustainable packaging practices to reduce their carbon footprint and plastic waste. This shift towards sustainability not only benefits the environment but also aligns with the expectations of consumers and regulators. As this market continues to evolve, it is likely to foster innovation and drive positive changes in the pharmaceutical industry, ultimately contributing to a more sustainable future.

Sustainable Pharmaceutical Packaging Market Segment Analysis

Sustainable Pharmaceutical Packaging Market segments cover the Material Type, End-Use Application, and Packaging Type. By Material Type Biodegradable Plastics segment is Anticipated to Dominate the Market Over the Forecast period.

The pharmaceutical industry is under increasing pressure to adopt sustainable practices. Traditional pharmaceutical packaging, often reliant on single-use plastics and energy-intensive manufacturing processes, has been a significant contributor to environmental degradation. This has led to the emergence of the sustainable pharmaceutical packaging market, which seeks to address these issues. Sustainable packaging options include biodegradable materials, recyclable packaging, reduced energy consumption during production, and innovative designs that minimize waste. Moreover, sustainable pharmaceutical packaging extends beyond materials to encompass responsible sourcing, efficient distribution, and end-of-life considerations.

Rapidly growing awareness of environmental concerns has been a driving force behind the expansion of this market. Consumers and regulatory bodies are increasingly demanding eco-friendly alternatives in pharmaceutical packaging, prompting pharmaceutical companies to re-evaluate their packaging strategies. Furthermore, sustainability in pharmaceutical packaging not only aligns with corporate social responsibility goals but also presents opportunities for cost reduction through improved supply chain efficiency and reduced waste disposal costs. As a result, the industry is witnessing a shift towards sustainable practices and a growing demand for environmentally responsible packaging solutions.

The Sustainable Pharmaceutical Packaging Market represents a crucial response to the pressing environmental issues associated with traditional pharmaceutical packaging. With the global awareness of environmental concerns on the rise, pharmaceutical companies are recognizing the need to adopt sustainable packaging practices to reduce their carbon footprint and plastic waste. This shift towards sustainability not only benefits the environment but also aligns with the expectations of consumers and regulators. As this market continues to evolve, it is likely to foster innovation and drive positive changes in the pharmaceutical industry, ultimately contributing to a more sustainable future.

The Sustainable Pharmaceutical Packaging Market Regional Analysis

Asia Pacific is dominating the Market Over the Forecast Period.

In Asia Pacific most countries have implemented strict environmental regulations and sustainability initiatives to combat pollution and promote eco-friendly practices. This includes regulations on packaging waste, recycling, and the use of environmentally friendly materials. Pharmaceutical companies operating in the region are compelled to adhere to these regulations, leading to a greater emphasis on sustainable packaging options. These regulations also encourage the adoption of sustainable packaging solutions to minimize the environmental impact of pharmaceutical products.

Growing environmental awareness and changing consumer preferences have contributed significantly to the rise of sustainable packaging in Asia Pacific. Consumers are increasingly seeking products that are packaged in an environmentally responsible manner. As a result, pharmaceutical companies are under pressure to adopt sustainable packaging to meet consumer expectations and maintain brand reputation. This shift in consumer sentiment towards eco-friendly packaging has driven the pharmaceutical industry to invest in sustainable alternatives

Asia Pacific is known for its cost-effective manufacturing capabilities, making it an attractive region for pharmaceutical companies looking to reduce production costs. Sustainable packaging materials and technologies have become more accessible and affordable in the region due to advancements in manufacturing processes and economies of scale. This cost-effectiveness has incentivized pharmaceutical companies to adopt sustainable packaging solutions, as they seek to balance environmental responsibility with cost savings.

Sustainable Pharmaceutical Packaging Market Top Key Players:

AptarGroup

SGD Pharma

Cormack Packaging

Westrock

Körber Medipak Systems

Billerudkorsnäs

Sanner Gmbh

Bilcare Limited

Constantia Flexibles

Bemis Company

Inc.

Comar

Nelipak Healthcare Packaging

Ecolean Ab

Dupont

Klockner Pentaplast

Elopak

Neopac

Südpack AND Other Major Players.

Sustainable Pharmaceutical Packaging Market Key Industry Developments

In November 2024, Körber’s Business Area Pharma continued to grow and strengthened its packaging competence by signing an agreement to acquire Wilhelm Bähren GmbH & Co. KG (Mönchengladbach, Germany). Bähren, an innovative supplier with a wide range of products for labels and leaflets in the pharmaceutical industry, significantly extended Körber’s existing packaging offerings for its customers.

In November 2024, Gilero, a Sanner Group Company and world-class medical device design, development, and contract manufacturer, expanded its manufacturing capabilities with a new 60,500 square foot (5,620 square meter) facility in Greensboro, North Carolina. The new facility was dedicated to producing critical components for medical devices and pharmaceutical packaging, as well as desiccant solutions to protect moisture-sensitive drugs and devices. The location of this facility established US-based injection molding and expanded manufacturing capabilities to meet growing customer demand.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Sustainable Pharmaceutical Packaging Market by Material Type (2018-2032)

4.1 Sustainable Pharmaceutical Packaging Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Biodegradable Plastics

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Recycled Materials

4.5 Paper

4.6 Cardboard

Chapter 5: Sustainable Pharmaceutical Packaging Market by End-Use Application (2018-2032)

5.1 Sustainable Pharmaceutical Packaging Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Prescription Medications

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Over-the-counter Medications

5.5 Biopharmaceuticals

5.6 Vaccines

5.7 Clinical Trial Packaging

Chapter 6: Sustainable Pharmaceutical Packaging Market by Packaging Type (2018-2032)

6.1 Sustainable Pharmaceutical Packaging Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Bottles & Containers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Blister Packs

6.5 Pouches & Bags

6.6 Ampoules & Vials

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Sustainable Pharmaceutical Packaging Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 FLOWSERVE CORPORATION (INDIA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 LARSEN & TOUBRO (INDIA)

7.4 DBV VALVE (CHINA)

7.5 KIRLOSKAR BROTHERS LIMITED (INDIA)

7.6 VIP VALVES (INDIA)

7.7 PENTAIR VALVE (UK)

7.8 HAWLE VALVES (INDIA)

7.9 XHVAL (CHINA)

7.10 BEL VALVES (UK)

7.11 FLUIDLINE VALVES (INDIA)

7.12 JC VALVES (UAE)

7.13 PETROL VALVES (ITALY)

7.14 VALVITALIA (ITALY)

7.15 NEWAY VALVE (CHINA)

7.16 WALWORTH (US)

7.17 EMERSON (US)

7.18 ALFA LAVAL (SWEDEN)

7.19 AVK HOLDING AS(DENMARK)

7.20 CIRCOR INTERNATIONAL (US)

7.21 SUFA TECHNOLOGY INDUSTRY (CHINA)

7.22 CRANE (US)

7.23 CURTISS-WRIGHT CORPORATION (US)

7.24 YUANDA VALVE (CHINA)

7.25 DANFOSS AS (DENMARK)

7.26 EG VALVES (CHINA)

7.27 SANHUA VALVE (CHINA)

7.28 DXP ENTERPRISES (US) OTHER MAJOR PLAYER.

Chapter 8: Global Sustainable Pharmaceutical Packaging Market By Region

8.1 Overview

8.2. North America Sustainable Pharmaceutical Packaging Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Material Type

8.2.4.1 Biodegradable Plastics

8.2.4.2 Recycled Materials

8.2.4.3 Paper

8.2.4.4 Cardboard

8.2.5 Historic and Forecasted Market Size by End-Use Application

8.2.5.1 Prescription Medications

8.2.5.2 Over-the-counter Medications

8.2.5.3 Biopharmaceuticals

8.2.5.4 Vaccines

8.2.5.5 Clinical Trial Packaging

8.2.6 Historic and Forecasted Market Size by Packaging Type

8.2.6.1 Bottles & Containers

8.2.6.2 Blister Packs

8.2.6.3 Pouches & Bags

8.2.6.4 Ampoules & Vials

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Sustainable Pharmaceutical Packaging Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Material Type

8.3.4.1 Biodegradable Plastics

8.3.4.2 Recycled Materials

8.3.4.3 Paper

8.3.4.4 Cardboard

8.3.5 Historic and Forecasted Market Size by End-Use Application

8.3.5.1 Prescription Medications

8.3.5.2 Over-the-counter Medications

8.3.5.3 Biopharmaceuticals

8.3.5.4 Vaccines

8.3.5.5 Clinical Trial Packaging

8.3.6 Historic and Forecasted Market Size by Packaging Type

8.3.6.1 Bottles & Containers

8.3.6.2 Blister Packs

8.3.6.3 Pouches & Bags

8.3.6.4 Ampoules & Vials

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Sustainable Pharmaceutical Packaging Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Material Type

8.4.4.1 Biodegradable Plastics

8.4.4.2 Recycled Materials

8.4.4.3 Paper

8.4.4.4 Cardboard

8.4.5 Historic and Forecasted Market Size by End-Use Application

8.4.5.1 Prescription Medications

8.4.5.2 Over-the-counter Medications

8.4.5.3 Biopharmaceuticals

8.4.5.4 Vaccines

8.4.5.5 Clinical Trial Packaging

8.4.6 Historic and Forecasted Market Size by Packaging Type

8.4.6.1 Bottles & Containers

8.4.6.2 Blister Packs

8.4.6.3 Pouches & Bags

8.4.6.4 Ampoules & Vials

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Sustainable Pharmaceutical Packaging Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Material Type

8.5.4.1 Biodegradable Plastics

8.5.4.2 Recycled Materials

8.5.4.3 Paper

8.5.4.4 Cardboard

8.5.5 Historic and Forecasted Market Size by End-Use Application

8.5.5.1 Prescription Medications

8.5.5.2 Over-the-counter Medications

8.5.5.3 Biopharmaceuticals

8.5.5.4 Vaccines

8.5.5.5 Clinical Trial Packaging

8.5.6 Historic and Forecasted Market Size by Packaging Type

8.5.6.1 Bottles & Containers

8.5.6.2 Blister Packs

8.5.6.3 Pouches & Bags

8.5.6.4 Ampoules & Vials

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Sustainable Pharmaceutical Packaging Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Material Type

8.6.4.1 Biodegradable Plastics

8.6.4.2 Recycled Materials

8.6.4.3 Paper

8.6.4.4 Cardboard

8.6.5 Historic and Forecasted Market Size by End-Use Application

8.6.5.1 Prescription Medications

8.6.5.2 Over-the-counter Medications

8.6.5.3 Biopharmaceuticals

8.6.5.4 Vaccines

8.6.5.5 Clinical Trial Packaging

8.6.6 Historic and Forecasted Market Size by Packaging Type

8.6.6.1 Bottles & Containers

8.6.6.2 Blister Packs

8.6.6.3 Pouches & Bags

8.6.6.4 Ampoules & Vials

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Sustainable Pharmaceutical Packaging Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Material Type

8.7.4.1 Biodegradable Plastics

8.7.4.2 Recycled Materials

8.7.4.3 Paper

8.7.4.4 Cardboard

8.7.5 Historic and Forecasted Market Size by End-Use Application

8.7.5.1 Prescription Medications

8.7.5.2 Over-the-counter Medications

8.7.5.3 Biopharmaceuticals

8.7.5.4 Vaccines

8.7.5.5 Clinical Trial Packaging

8.7.6 Historic and Forecasted Market Size by Packaging Type

8.7.6.1 Bottles & Containers

8.7.6.2 Blister Packs

8.7.6.3 Pouches & Bags

8.7.6.4 Ampoules & Vials

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Sustainable Pharmaceutical Packaging Market research report?

A1: The forecast period in the Sustainable Pharmaceutical Packaging Market research report is 2024-2032.

Q2: Who are the key players in the Sustainable Pharmaceutical Packaging Market?

A2: AptarGroup, SGD Pharma, Cormack Packaging, Westrock, Körber Medipak Systems, Billerudkorsnäs, Sanner Gmbh, Bilcare Limited, Constantia Flexibles, Bemis Company, Inc., Comar, Nelipak Healthcare Packaging, Ecolean Ab, Dupont, Klockner Pentaplast, Elopak, Neopac, Südpack and Other Major Players.

Q3: What are the segments of the Sustainable Pharmaceutical Packaging Market?

A3: The Sustainable Pharmaceutical Packaging Market is segmented into Material Type, End-Use Application, Packaging Type, and Region. By Material Type, the market is categorized into Biodegradable Plastics, Recycled Materials, Paper, And Cardboard. By End-Use Applications, the market is categorized into Prescription Medications, Over-The-Counter (OTC) Medications, Biopharmaceuticals, Vaccines, and Clinical Trial Packaging. By Packaging Type, the market is categorized into Bottles and containers, Blister Packs, Pouches and bags, Ampoules & Vials. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Sustainable Pharmaceutical Packaging Market?

A4: The sustainable pharmaceutical packaging market refers to the segment of the pharmaceutical industry that focuses on creating environmentally friendly and socially responsible packaging solutions for pharmaceutical products. This market has emerged in response to growing concerns about the environmental impact of traditional packaging materials, such as plastic, and the pharmaceutical industry's commitment to reducing its carbon footprint. Sustainable pharmaceutical packaging aims to minimize waste, reduce energy consumption, and promote the use of recyclable and biodegradable materials in packaging design.

Q5: How big is the Sustainable Pharmaceutical Packaging Market?

A5: Sustainable Pharmaceutical Packaging Market size was valued at USD 83.2 billion in 2023 and is projected to reach USD 307.68 billion by 2032, growing at a CAGR of 15.64% from 2024 to 2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!