Stay Ahead in Fast-Growing Economies.

Browse Reports NowAngiography Imaging Systems Market-Latest Advancement And Industry Analysis

Angiography also called arteriography is an imaging technique applied in medicine to help professionals in visualizing the anatomical details or lumen of blood vessels and organs of the body, like the arteries, veins, and heart chambers. Mainly performed on blood vessels and heart the procedure is also helpful in visualizing the flow of blood to and from the brain, which is helpful in diagnosing aneurysms and performing intervention work on coil-embolized aneurysms.

IMR Group

Description

Angiography Imaging Systems Market Synopsis

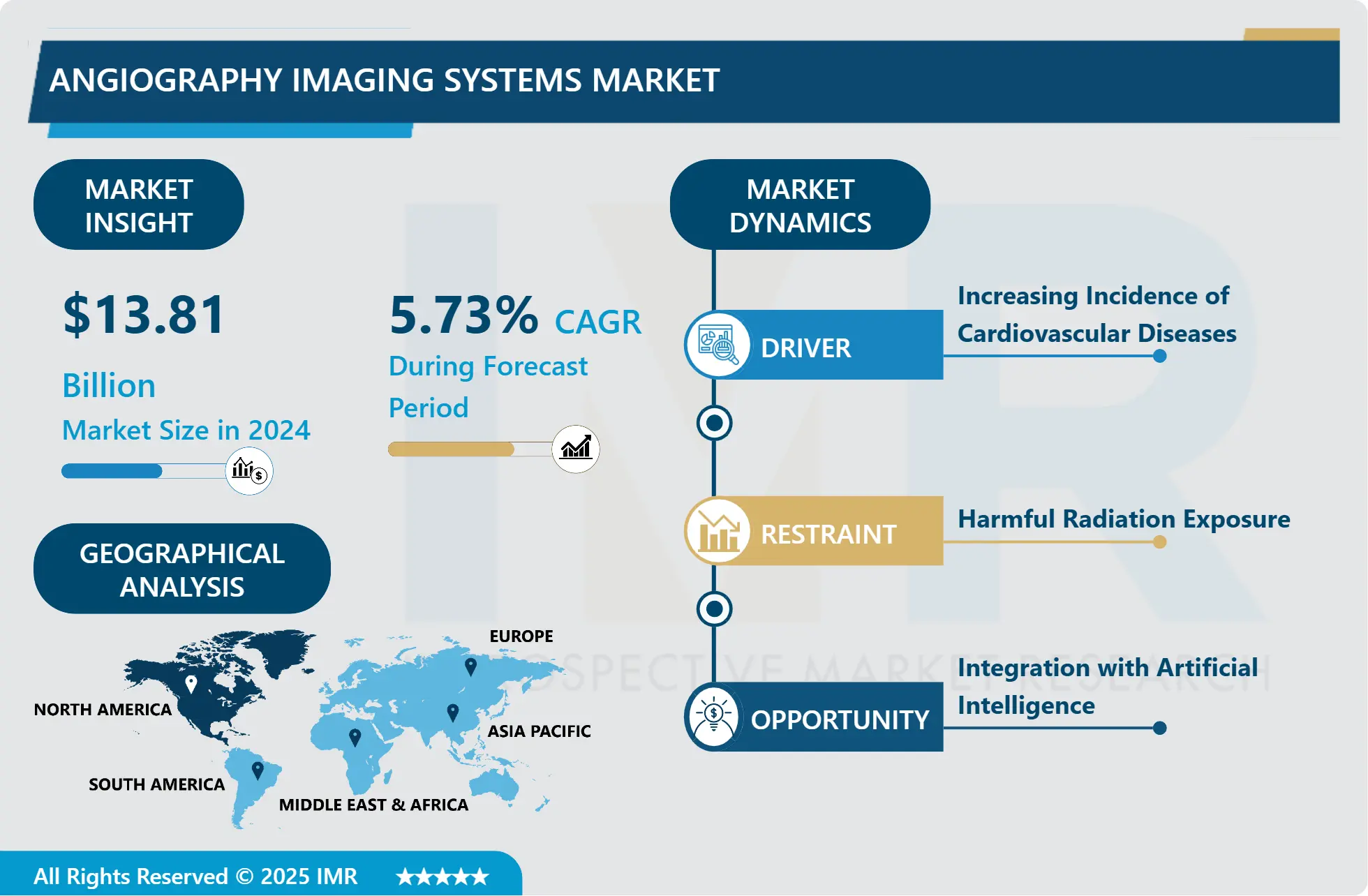

Angiography Imaging Systems Market Size Was Valued at USD 13.81 Billion in 2024 and is Projected to Reach USD 21.57 Billion by 2032, Growing at a CAGR of 5.73% From 2025-2032.

Angiography Imaging Systemsare an automated process used to create rapid prototypes and functional end-use parts that have witnessed increasing demand from healthcare, automotive, and other industries globally Angiography imaging systems are medical devices used to visualize blood vessels in the body. These systems typically involve injecting a contrast dye into the bloodstream, which highlights the blood vessels on X-ray images or other imaging modalities such as CT scans or MRI scans.

Angiography imaging systems are crucial in medical fields for visualizing blood vessels and blood flow within the body. They are used for diagnostic purposes to identify blockages, narrowing, or abnormalities in blood vessels, aiding in diagnosing conditions like coronary artery disease, peripheral artery disease, and cerebrovascular disease. They are also essential for guiding minimally invasive interventional procedures, such as angioplasty, stent placement, embolization, thrombolysis, and arterial catheterization.

Angiography systems are also used in cardiology for cardiac catheterization, assessing coronary artery disease severity, and guiding interventions. They are also vital in neuro interventional radiology for diagnosing and treating brain and spinal cord conditions, such as aneurysms, arteriovenous malformations, and strokes. Angiography systems are also used in peripheral vascular imaging to assess blood flow and detect blockages in arteries and veins, aiding in diagnosing conditions like peripheral artery disease, deep vein thrombosis, and abdominal aortic aneurysms.

The increasing incidence of cardiovascular diseases worldwide necessitates the use of diagnostic tools like angiography imaging systems. Technological advancements in medical imaging, such as improved image quality and minimally invasive procedures, have increased the demand for advanced systems. The aging population, prone to cardiovascular diseases, and rising healthcare expenditure also drive the demand for these systems. Increased awareness about early detection and screening programs has led to more people seeking diagnostic procedures.

Emerging markets with improved healthcare infrastructure and rising disposable incomes are also driving demand for angiography systems. The trend towards minimally invasive procedures, such as CT and MRI, further increased the demand for angiography systems.

Angiography Imaging Systems Market Trend Analysis

Increasing Incidence of Cardiovascular Diseases

Cardiovascular diseases encompass a range of conditions affecting the heart and blood vessels, including coronary artery disease, stroke, peripheral arterial disease, and others. These diseases collectively represent one of the leading causes of morbidity and mortality globally. Over the past few decades, steady increase in the prevalence of cardiovascular diseases worldwide. Factors contributing to this rise include sedentary lifestyles, unhealthy dietary habits, tobacco use, obesity, and increasing life expectancy.

The burden of cardiovascular diseases places significant strain on healthcare systems, necessitating effective diagnostic and treatment strategies. Angiography imaging systems play a crucial role in the diagnosis and management of cardiovascular conditions by providing detailed images of blood vessels and identifying blockages, narrowing, or abnormalities. Accurate and timely diagnosis is critical for the effective management of cardiovascular diseases. Angiography imaging systems enable healthcare professionals to visualize the anatomy and function of blood vessels, aiding in the diagnosis of conditions such as coronary artery disease, peripheral artery disease, congenital heart defects, and aneurysms.

Diagnosis and angiography imaging systems are used to guide various interventional procedures aimed at treating cardiovascular diseases. High-quality angiographic images are essential for precise catheter placement and real-time visualization during these procedures. Following diagnosis and intervention, angiography imaging systems are also utilized for patient management and follow-up care. Serial angiographic studies may be performed to monitor disease progression, assess treatment efficacy, and guide further therapeutic interventions as needed.

The aging population demographic is particularly susceptible to cardiovascular diseases due to age-related changes in the cardiovascular system, such as arterial stiffness, atherosclerosis, and increased prevalence of comorbidities. As the global population continues to age, the incidence of cardiovascular diseases is expected to rise further, driving sustained demand for angiography imaging systems.

Angiography Imaging Systems Market Restraints – Harmful Radiation Exposure

The primary concern with angiography imaging systems is the potential for harmful radiation exposure to patients, clinicians, and medical staff. Prolonged or excessive exposure to ionizing radiation can increase the risk of various health issues, including cancer and genetic mutations. the radiation dose from a single angiography procedure may be relatively low, repeated or cumulative exposure over time can lead to significant health risks, particularly for patients undergoing multiple procedures or healthcare professionals routinely working with angiography systems.

Ensuring patient safety is paramount in medical imaging. Healthcare providers must carefully balance the diagnostic benefits of angiography procedures with the potential risks associated with radiation exposure. Minimizing radiation dose while maintaining image quality is crucial to mitigating these risks. Healthcare professionals who operate angiography imaging systems are also at risk of radiation exposure. Without proper safety measures and protective equipment, such as lead aprons, thyroid shields, and radiation monitoring devices, medical staff may be vulnerable to the harmful effects of ionizing radiation.

Radiation exposure can cause anxiety and concern among patients undergoing angiography procedures, particularly those who are sensitive to medical radiation or have existing health conditions. Healthcare providers should communicate effectively with patients, addressing their concerns and providing clear information about the benefits and risks of the procedure.

Angiography Imaging Systems Market Opportunity – Integration with Artificial Intelligence

AI algorithms can analyze angiography images more efficiently and accurately than traditional methods, aiding in the detection of subtle abnormalities or early signs of disease. This can lead to more precise diagnosis and treatment planning, ultimately improving patient outcomes. AI can automate routine tasks involved in angiography imaging analysis, such as image segmentation, feature extraction, and measurement, reducing the workload on healthcare professionals and potentially speeding up the diagnostic process.

By analyzing large datasets of angiography images along with clinical data, AI can help tailor treatments to individual patients based on their unique characteristics and disease profiles. This personalized approach can optimize treatment efficacy and minimize adverse effects. Integrating AI with angiography systems enables real-time decision support for clinicians during procedures. AI algorithms can provide instant feedback on image quality, guide catheter placement, and assist in identifying optimal imaging parameters, improving procedural efficiency and safety.

AI can help standardize imaging protocols and quality metrics across different healthcare facilities by providing automated quality assessment tools. This ensures consistency in image acquisition and interpretation, leading to more reliable and reproducible results. AI-powered angiography imaging systems facilitate research into novel imaging biomarkers, treatment strategies, and disease mechanisms. By analyzing vast amounts of imaging data, AI can uncover new insights that may lead to the development of innovative diagnostic and therapeutic approaches.

Angiography Imaging Systems Market Challenges- High Cost and Accessibility

Angiography imaging systems are sophisticated medical devices that require substantial initial investment for acquisition. The cost includes not only the equipment itself but also installation, training, maintenance, and potential upgrades. This high initial cost can be a significant barrier for healthcare facilities, particularly those in resource-constrained settings or smaller clinics with limited budgets. Beyond the initial purchase, angiography systems require regular maintenance and servicing to ensure optimal performance and longevity. These ongoing expenses can add up over time and may strain the financial resources of healthcare providers, particularly in regions where access to specialized technical support is limited.

The operation of angiography systems involves additional expenses such as staff training, consumables, and utilities. These operational costs can further contribute to the overall financial burden associated with maintaining and using angiography systems. Angiography imaging systems are often concentrated in urban areas and regions with advanced healthcare infrastructure, leading to disparities in accessibility for individuals residing in rural or underserved areas. The lack of accessibility may result in delayed diagnosis and treatment for patients in these regions, exacerbating health inequalities.

In some healthcare systems, reimbursement policies and financial coverage for angiography procedures may be insufficient, leading to financial strain for patients and healthcare providers alike. This can reduce the affordability of angiography imaging services and limit access for certain patient populations. Rapid advancements in medical imaging technology may lead to the obsolescence of older angiography systems, necessitating costly upgrades or replacements to maintain clinical standards. This challenge further exacerbates the financial burden associated with angiography imaging systems over their lifecycle

Angiography Imaging Systems Market Segment Analysis:

Angiography Imaging Systems Market Segmented based on technology, application, and end-users.

By Technology, X-ray Angiography segment is expected to dominate the market during the forecast period

X-ray angiography is a standard and widely used imaging technique for visualizing blood vessels for many years. Its long history and established track record in clinical practice give it a strong foundation and widespread acceptance among healthcare providers. X-ray angiography offers real-time imaging capabilities, allowing clinicians to visualize blood flow dynamically during interventional procedures. This real-time feedback is crucial for guiding minimally invasive interventions such as angioplasty, stent placement, and embolization.

X-ray angiography provides high spatial resolution images, enabling detailed visualization of vascular anatomy and pathology. This level of detail is essential for accurately diagnosing and treating various cardiovascular conditions, including coronary artery disease, peripheral artery disease, and cerebral vascular disorders. X-ray angiography plays a central role in interventional radiology and cardiology procedures. Its ability to guide catheter-based interventions in real-time makes it indispensable for treating a wide range of vascular diseases.

While the initial investment for X-ray angiography equipment can be significant, its widespread adoption and established reimbursement mechanisms contribute to its overall cost-effectiveness. However, the high throughput and versatility of X-ray angiography systems make them valuable assets for healthcare facilities seeking to maximize resource utilization. X-ray angiography is utilized across a broad spectrum of clinical specialties, including cardiology, radiology, neurology, vascular surgery, and interventional oncology. Its versatility and applicability to diverse patient populations make it a versatile tool for diagnosing and treating various vascular disorders.

By Application, the Cardiology segment held the largest share of 41.34% in 2024

Angiography imaging systems are extensively used in cardiology for diagnosing and treating peripheral vascular diseases, coronary artery diseases, and other cardiovascular conditions. These systems play a crucial role in procedures such as angioplasty, stent placement, embolization, and intravascular imaging. Given the high prevalence of cardiovascular diseases globally and the increasing adoption of minimally invasive interventions, the cardiology segment tends to hold the largest share of angiography imaging system utilization.

Angiography imaging systems are integral to both the diagnosis and treatment of cardiovascular conditions. They provide detailed visualization of the coronary arteries, peripheral vasculature, and cardiac chambers, enabling clinicians to assess anatomical abnormalities, stenoses, and blockages. Furthermore, these systems guide minimally invasive procedures such as angioplasty, stent placement, and transcatheter valve interventions. The field of interventional cardiology witnessed significant advancements in recent decades, leading to a shift towards less invasive treatment approaches. Angiography imaging systems play a central role in these procedures by providing real-time visualization and guidance, thereby facilitating safer and more effective interventions.

The rise of structural heart interventions, angiography imaging systems become indispensable tools for pre-procedural planning, intra-procedural guidance, and post-procedural assessment. The utilization of angiography imaging systems in cardiology is supported by established reimbursement mechanisms and clinical guidelines.

Angiography Imaging Systems Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

North America, particularly the United States boasts a highly developed healthcare infrastructure with sophisticated medical facilities, advanced technologies, and skilled healthcare professionals. This infrastructure supports the widespread adoption and utilization of angiography imaging systems in clinical practice. Cardiovascular diseases, including coronary artery disease, peripheral artery disease, and stroke, remain significant health concerns in North America. The region has a relatively high prevalence of these conditions, driving the demand for diagnostic and interventional procedures that rely on angiography imaging systems for accurate visualization and treatment guidance.

North America is a global leader in medical technology innovation, with numerous research institutions, academic medical centers, and medical device companies driving advancements in imaging technologies, including angiography systems. This culture of innovation fosters the development and adoption of cutting-edge angiography imaging systems in the region. The United States, in particular, has a robust healthcare reimbursement system that often covers angiography procedures for diagnosing and treating cardiovascular diseases. This favorable reimbursement environment incentivizes healthcare providers to invest in angiography imaging systems and utilize them for a wide range of clinical applications.

Angiography Imaging Systems Market Top Key Players:

GE Healthcare (US)

Carestream Health (US)

Hologic, Inc. (US)

Konica Minolta Healthcare Americas, Inc. (US)

Boston Scientific Corporation (US)

Angiodynamics, Inc. (US)

Stryker Corporation (US)

Siemens Healthineers (Germany)

Ziehm Imaging (Germany)

B. Braun Melsungen AG (Germany)

Smiths Group plc (UK)

Philips Healthcare (Netherlands)

Esaote SpA (Italy)

Medtronic plc (Ireland)

Agfa-Gevaert Group (Belgium)

Mindray Medical International Limited (China)

Canon Medical Systems Corporation (Japan)

Shimadzu Corporation (Japan)

Hitachi Healthcare (Japan)

Toshiba Medical Systems Corporation (Japan)

Fujifilm Medical Systems (Japan)

Terumo Corporation (Japan)

Nipro Corporation (Japan)

Samsung Medison (South Korea), and Other Active Players

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Angiography Imaging Systems Market by Technology (2018-2032)

4.1 Angiography Imaging Systems Market Snapshot and Growth Engine

4.2 Market Overview

4.3 X-ray Angiography

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 CT Angiography

4.5 MRI Angiography

4.6 MR-CT Angiography

Chapter 5: Angiography Imaging Systems Market by Application (2018-2032)

5.1 Angiography Imaging Systems Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cardiology

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Oncology

5.5 Neurology

5.6 Peripheral and Vascular Intervention

5.7 Others

Chapter 6: Angiography Imaging Systems Market by End User (2018-2032)

6.1 Angiography Imaging Systems Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Ambulatory Surgical Centers

6.5 Diagnostic Centers

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Angiography Imaging Systems Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BASF CORPORATION (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CORTEVA AGRISCIENCE (US)

7.4 MARRONE BIO INNOVATIONS (US)

7.5 VALENT BIOSCIENCES LLC (US)

7.6 CERTIS USA LLC (US)

7.7 INDIGO AGRICULTURE (US)

7.8 PRECISION LABORATORIES

7.9 LLC (US)

7.10 VERDESIAN LIFE SCIENCES (US)

7.11 BIOWORKS INC. (US)

7.12 VALENT U.S.A. LLC (US)

7.13 MARRONE ORGANIC INNOVATIONS (US)

7.14 BAYER AG (GERMANY)

7.15 BAYER CROPSCIENCE (GERMANY)

7.16 BASF SE (GERMANY)

7.17 PLANT HEALTH CARE PLC (UK)

7.18 KOPPERT BIOLOGICAL SYSTEMS (NETHERLANDS)

7.19 ITALPOLLINA S.P.A (ITALY)

7.20 ISAGRO S.P.A (ITALY)

7.21 SYNGENTA GROUP (SWITZERLAND)

7.22 ANDERMATT BIOCONTROL AG (SWITZERLAND)

7.23 CAMSON BIO TECHNOLOGIES LIMITED (INDIA)

7.24 UPL LIMITED (INDIA)

7.25 NOVOZYMES A/S (DENMARK)

7.26 ADAMA AGRICULTURAL SOLUTIONS LTD. (ISRAEL)

7.27 RIZOBACTER ARGENTINA S.A. (ARGENTINA)

7.28

Chapter 8: Global Angiography Imaging Systems Market By Region

8.1 Overview

8.2. North America Angiography Imaging Systems Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Technology

8.2.4.1 X-ray Angiography

8.2.4.2 CT Angiography

8.2.4.3 MRI Angiography

8.2.4.4 MR-CT Angiography

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Cardiology

8.2.5.2 Oncology

8.2.5.3 Neurology

8.2.5.4 Peripheral and Vascular Intervention

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Hospitals

8.2.6.2 Ambulatory Surgical Centers

8.2.6.3 Diagnostic Centers

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Angiography Imaging Systems Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Technology

8.3.4.1 X-ray Angiography

8.3.4.2 CT Angiography

8.3.4.3 MRI Angiography

8.3.4.4 MR-CT Angiography

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Cardiology

8.3.5.2 Oncology

8.3.5.3 Neurology

8.3.5.4 Peripheral and Vascular Intervention

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Hospitals

8.3.6.2 Ambulatory Surgical Centers

8.3.6.3 Diagnostic Centers

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Angiography Imaging Systems Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Technology

8.4.4.1 X-ray Angiography

8.4.4.2 CT Angiography

8.4.4.3 MRI Angiography

8.4.4.4 MR-CT Angiography

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Cardiology

8.4.5.2 Oncology

8.4.5.3 Neurology

8.4.5.4 Peripheral and Vascular Intervention

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Hospitals

8.4.6.2 Ambulatory Surgical Centers

8.4.6.3 Diagnostic Centers

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Angiography Imaging Systems Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Technology

8.5.4.1 X-ray Angiography

8.5.4.2 CT Angiography

8.5.4.3 MRI Angiography

8.5.4.4 MR-CT Angiography

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Cardiology

8.5.5.2 Oncology

8.5.5.3 Neurology

8.5.5.4 Peripheral and Vascular Intervention

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Hospitals

8.5.6.2 Ambulatory Surgical Centers

8.5.6.3 Diagnostic Centers

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Angiography Imaging Systems Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Technology

8.6.4.1 X-ray Angiography

8.6.4.2 CT Angiography

8.6.4.3 MRI Angiography

8.6.4.4 MR-CT Angiography

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Cardiology

8.6.5.2 Oncology

8.6.5.3 Neurology

8.6.5.4 Peripheral and Vascular Intervention

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Hospitals

8.6.6.2 Ambulatory Surgical Centers

8.6.6.3 Diagnostic Centers

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Angiography Imaging Systems Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Technology

8.7.4.1 X-ray Angiography

8.7.4.2 CT Angiography

8.7.4.3 MRI Angiography

8.7.4.4 MR-CT Angiography

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Cardiology

8.7.5.2 Oncology

8.7.5.3 Neurology

8.7.5.4 Peripheral and Vascular Intervention

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Hospitals

8.7.6.2 Ambulatory Surgical Centers

8.7.6.3 Diagnostic Centers

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Angiography Imaging Systems Market research report?

A1: The forecast period in the Angiography Imaging Systems Market research report is 2025-2032.

Q2: Who are the key players in the Angiography Imaging Systems Market?

A2: GE Healthcare (US), Carestream Health (US), Hologic, Inc. (US), Konica Minolta Healthcare Americas, Inc. (US), Hologic, Inc. (US), Boston Scientific Corporation (US), Angiodynamics, Inc. (US), Stryker Corporation (US), Siemens Healthineers (Germany), Ziehm Imaging (Germany), B. Braun Melsungen AG (Germany), Smiths Group plc (UK), Philips Healthcare (Netherlands), Esaote SpA (Italy), Medtronic plc (Ireland), Agfa-Gevaert Group (Belgium), Mindray Medical International Limited (China), Canon Medical Systems Corporation (Japan), Shimadzu Corporation (Japan), Hitachi Healthcare (Japan), Toshiba Medical Systems Corporation (Japan), Fujifilm Medical Systems (Japan), Terumo Corporation (Japan), Nipro Corporation (Japan), Samsung Medison (South Korea) and Other Active Players.

Q3: What are the segments of the Angiography Imaging Systems Market?

A3: The Angiography Imaging Systems Market is segmented into Technology, Application, End- User and region. By Technology, the market is categorized into X-ray Angiography, CT Angiography, MRI Angiography, and MR-CT Angiography. By Application, the market is categorized into (Cardiology, Oncology, Neurology, Peripheral and Vascular Intervention, and Others. By End User, the market is categorized into Hospitals, Ambulatory Surgical Centers, Diagnostic Centers, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Angiography Imaging Systems Market?

A4: The Angiography Imaging Systems Market refers to the segment of the medical device industry focused on the production, distribution, and utilization of imaging systems used for angiography procedures. Angiography imaging systems are medical devices that generate detailed images of blood vessels and the circulatory system, enabling healthcare professionals to diagnose and treat various cardiovascular and neurological conditions. These systems utilize techniques such as X-ray angiography, CT angiography, MRI angiography, and hybrid imaging modalities to visualize blood flow, detect blockages or abnormalities, and guide minimally invasive interventions.

Q5: How big is the Angiography Imaging Systems Market?

A5: Angiography Imaging Systems Market Size Was Valued at USD 13.81 Billion in 2024 and is Projected to Reach USD 21.57 Billion by 2032, Growing at a CAGR of 5.73% From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!