Stay Ahead in Fast-Growing Economies.

Browse Reports NowData Center Generator Market-Latest Advancement And Industry Analysis

In the event of a power outage, generators serve as the data centers’ backup power source. A complete loss of power at a data center may need a complete restart of the system, which could cause start-up problems, system downtime, and the loss of existing and continuing information.

IMR Group

Description

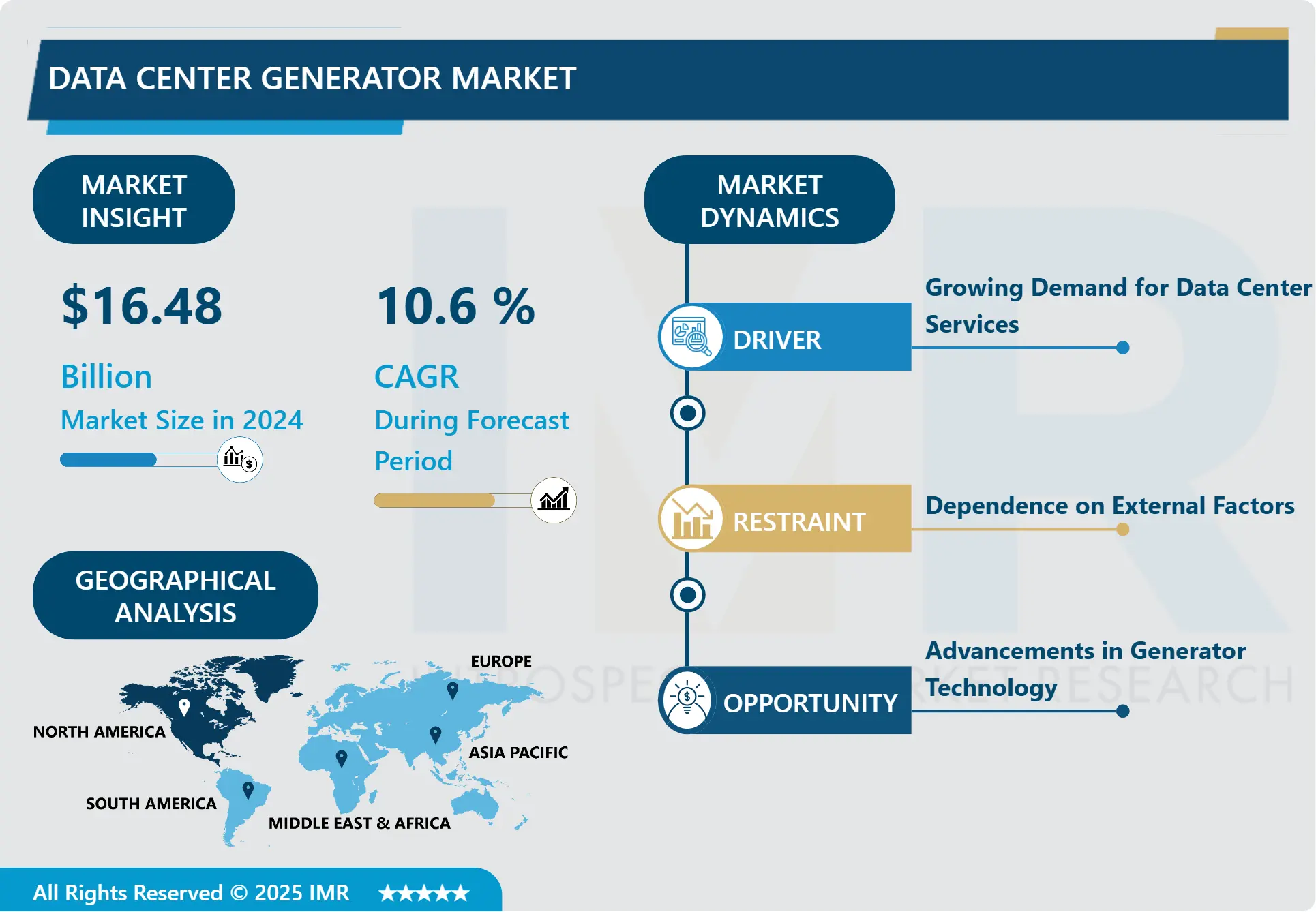

Data Center Generator Market Synopsis

Data Center Generator Market Size Was Valued at USD 16.48 Billion in 2024 and is Projected to Reach USD 36.9 Billion by 2032, Growing at a CAGR of 10.6 % From 2025-2032.

A data center generator is a backup power source used to provide electricity to a data center in the event of a power outage or disruption. These generators are typically diesel-powered and can quickly activate to maintain the continuous operation of critical IT infrastructure, ensuring uninterrupted access to data and services. They are essential for data centers to maintain uptime and prevent data loss during power failures.

Data center generators are crucial for ensuring uninterrupted power supply to data centers, which are essential for the operation of digital services and infrastructure. They serve as the primary power source, providing electricity to critical IT equipment, servers, networking devices, and cooling systems during power outages. They often work with uninterruptible power supply (UPS) systems to provide immediate power backup during short outages or voltage fluctuations.

Data center generators are also used for load balancing and peak demand management, optimizing energy usage and reducing utility costs. Regular testing and maintenance ensure their reliability and performance. They are essential for emergency preparedness and disaster recovery, providing a reliable power source during natural disasters. In remote or edge data centers, generators provide a continuous power supply, allowing them to operate effectively without relying solely on the grid. They also help meet regulatory requirements for uptime and data availability.

Data centers require uninterrupted power to maintain critical IT infrastructure. Generators serve as backup power sources in case of grid power failures, ensuring data continuity and preventing service disruptions. They also provide scalability to meet the growing power needs of data centers, ensuring flexibility and scalability. Redundancy is crucial in data center design to mitigate equipment failure or power loss.

Generators help data centers comply with regulatory standards by providing backup power and ensuring data integrity. They also play a critical role in disaster recovery plans, allowing businesses to maintain operations and recover data during prolonged outages. In remote or rural areas, generators provide a reliable and independent source of power, ensuring continuous operation regardless of grid power availability or quality.

Data Center Generator Market Trend Analysis

Growing Demand for Data Center Services

The proliferation of digital technologies, the volume of data generated and processed by businesses and individuals is growing exponentially. This includes data from e-commerce transactions, social media interactions, cloud computing, streaming services, IoT devices, and more. As organizations rely more heavily on data to drive their operations and decision-making processes, the demand for data center services to store, process, and manage this data continues to rise.

The adoption of cloud computing services, including infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS), is driving the expansion of data center infrastructure. Cloud service providers operate massive data centers that require robust backup power systems to ensure uninterrupted service delivery to their customers.

Many businesses are undergoing digital transformation initiatives to stay competitive in today’s digital economy. This involves modernizing IT infrastructure, migrating to the cloud, implementing big data analytics, adopting IoT solutions, and enhancing cybersecurity measures, among other strategies. These initiatives often entail the expansion or upgrade of data center facilities to accommodate new technologies and support increased workloads, driving the need for reliable backup power solutions like generators.

Downtime in data centers can have severe consequences, including financial losses, reputational damage, and regulatory non-compliance. The growing demand for data center services underscores the importance of investing in resilient infrastructure, including backup power solutions, to minimize the risk of downtime and maintain continuous operations.

Restraint

Dependence on External Factors

Data center generators rely on fuel sources like diesel, natural gas, or propane for power during outages. However, external factors like fuel availability, delivery schedules, and supply chain disruptions can affect generator reliability. Regulatory compliance can also affect data center operations, as changes in standards or permitting processes may require modifications to fuel storage facilities or operational procedures.

Weather events can disrupt fuel supply chains and infrastructure, impairing generator fuel availability. Utility grid stability is crucial for generators’ effectiveness, as factors like grid congestion, voltage fluctuations, and equipment failures can affect their ability to transition to backup power mode.

Regular maintenance and service providers can introduce delays and logistical challenges. To address these risks, data center operators should implement comprehensive risk management strategies, such as diversifying fuel sources and establishing contingency plans.

Advancements in Generator Technology

Advancements in generator technology have significantly improved the reliability, efficiency, and sustainability of backup power systems in the data center industry. Modern generators are equipped with advanced monitoring and control systems, providing real-time performance data and predictive maintenance capabilities, ensuring continuous operations even during power outages or grid failures.

Innovative designs, such as variable speed engines and fuel injection systems, have improved fuel efficiency, reducing operating costs and minimizing environmental footprint. Scalability is also enhanced, with modular designs allowing data center operators to easily expand backup power capacity without extensive downtime or costly retrofitting.

As sustainability becomes a top priority, there is growing interest in integrating renewable energy sources with backup power systems, such as solar and wind power. Modern generators also offer remote monitoring and management capabilities, allowing operators to monitor performance, diagnose issues, and perform maintenance tasks remotely, improving operational efficiency and system reliability.

Challenge

Scalability and Redundancy

Data centers often experience fluctuations in power requirements due to changes in workload, seasonal variations, or expansion of infrastructure. Scalability refers to the ability of the generator system to accommodate these fluctuations by efficiently adjusting its capacity. Ensuring scalability is crucial to prevent overloading or underutilization of generator capacity, which can impact performance and reliability.

Redundancy is essential for mitigating the risk of downtime in data center operations. It involves duplicating critical components or systems to provide backup in case of failures or maintenance activities. In the context of data center generators, redundancy typically includes redundant generator units, fuel systems, cooling systems, and electrical distribution infrastructure.

Data Center Generator Market Segment Analysis:

Data Center Generator Market Segmented based on product, capacity, and tier.

By Product, Diesel segment is expected to dominate the market during the forecast period

Diesel generators are reliable and robust, providing consistent and stable power output, making them ideal for critical applications like data centers. They offer higher power density than alternative fuel sources like natural gas or propane, allowing them to deliver more power in a smaller footprint.

Diesel fuel is widely available and can be stored on-site, ensuring continuous operation during power outages or emergencies. They have quick start-up times, allowing them to respond quickly to power disruptions and provide backup power to critical loads.

Diesel generators offer scalability, allowing operators to add additional capacity as power requirements grow. Despite advancements in alternative energy sources, diesel generators remain a cost-effective option for data center backup power generation due to their low upfront costs, long service life, and minimal maintenance requirements.

By Tier, Tier III segment held the largest share of 33.54% in 2024

Tier III data centers are crucial for businesses seeking a balance between cost and reliability, offering redundancy in power and cooling systems for continuous operation. These centers require robust backup power solutions like generators to maintain uptime during grid power outages or maintenance events.

The growth in data center construction worldwide has driven the demand for generators, particularly in Tier III facilities. Power resilience is a priority for Tier III data centers, with generators playing a critical role in providing backup power during grid failures or emergencies. Regulatory compliance and industry standards often mandate specific levels of redundancy and reliability for data center operations, especially for critical applications or sensitive data.

Tier III certification, based on the Uptime Institute’s standards, ensures data centers meet stringent reliability criteria. Business continuity and disaster recovery are essential considerations for Tier III data centers, with redundant power systems offering higher levels of assurance.

Data Center Generator Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

China is among the fastest-growing markets in terms of new technologies and the usage of innovative materials for construction purposes. With China’s dominating role as a global construction center, the accelerated development in the 3D concrete printing sector is likely to revolutionize the traditional construction industry in the country, with applications ranging from residential buildings to monuments.

The country is involved in the construction of buildings, offices, and bridges using 3D printing technology. Additionally, Shanghai is the home of the longest 3D-printed bridge, which is 86 feet in length in the world, consisting of 176 concrete units.

Data Center Generator Market Top Key Players:

Cummins Inc. (US)

Caterpillar Inc. (US)

Generac Power Systems, Inc. (US)

Kohler Co. (US)

Briggs & Stratton Corporation (US)

Marathon Electric (US)

Siemens AG (Germany)

Deutz AG (Germany)

MTU Onsite Energy (Germany)

Aggreko plc (UK)

Rolls-Royce Holdings plc (UK)

FG Wilson (UK)

JCB Power Products Ltd. (UK)

Schneider Electric SE (France)

Himoinsa S.L. (Spain)

Atlas Copco AB (Sweden)

Kirloskar Oil Engines Limited (India)

Yanmar Holdings Co., Ltd. (Japan)

Mitsubishi Corporation (Japan)

Doosan Corporation (South Korea), and other active players

Key Industry Developments in the Data Center Generator Market:

In March 2024, Amazon Web Services (AWS) expanded its data center capacity by acquiring a notable data center, which ran on nuclear energy. The acquired data center, operated by energy producer Talen Energy, powered its infrastructure using energy generated from a nearby nuclear power plant. The acquisition did not alter this setup; AWS retained the existing infrastructure and power supplies as part of the deal. This arrangement was possible because the nuclear power plant also belonged to Talen Energy, ensuring continuity in energy sourcing for the data center.

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter’s Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Data Center Generator Market by Product (2018-2032)

4.1 Data Center Generator Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Diesel

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Natural Gas

4.5 Others

Chapter 5: Data Center Generator Market by Capacity (2018-2032)

5.1 Data Center Generator Market Snapshot and Growth Engine

5.2 Market Overview

5.3 2MW

Chapter 6: Data Center Generator Market by Tier (2018-2032)

6.1 Data Center Generator Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Tier I and II

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Tier III

6.5 Tier IV

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Data Center Generator Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 SCHNEIDER ELECTRIC

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 VERTIV

7.4 EATON CORPORATION

7.5 ABB

7.6 LEGRAND

7.7 RARITAN (A BRAND OF LEGRAND)

7.8 SERVER TECHNOLOGY (A BRAND OF LEGRAND)

7.9 TRIPP LITE

7.10 CYBERPOWER SYSTEMS

7.11 CISCO SYSTEMS

7.12 OTHER KEY PLAYERS

7.13

Chapter 8: Global Data Center Generator Market By Region

8.1 Overview

8.2. North America Data Center Generator Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product

8.2.4.1 Diesel

8.2.4.2 Natural Gas

8.2.4.3 Others

8.2.5 Historic and Forecasted Market Size by Capacity

8.2.5.1 2MW

8.2.6 Historic and Forecasted Market Size by Tier

8.2.6.1 Tier I and II

8.2.6.2 Tier III

8.2.6.3 Tier IV

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Data Center Generator Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product

8.3.4.1 Diesel

8.3.4.2 Natural Gas

8.3.4.3 Others

8.3.5 Historic and Forecasted Market Size by Capacity

8.3.5.1 2MW

8.3.6 Historic and Forecasted Market Size by Tier

8.3.6.1 Tier I and II

8.3.6.2 Tier III

8.3.6.3 Tier IV

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Data Center Generator Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product

8.4.4.1 Diesel

8.4.4.2 Natural Gas

8.4.4.3 Others

8.4.5 Historic and Forecasted Market Size by Capacity

8.4.5.1 2MW

8.4.6 Historic and Forecasted Market Size by Tier

8.4.6.1 Tier I and II

8.4.6.2 Tier III

8.4.6.3 Tier IV

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Data Center Generator Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product

8.5.4.1 Diesel

8.5.4.2 Natural Gas

8.5.4.3 Others

8.5.5 Historic and Forecasted Market Size by Capacity

8.5.5.1 2MW

8.5.6 Historic and Forecasted Market Size by Tier

8.5.6.1 Tier I and II

8.5.6.2 Tier III

8.5.6.3 Tier IV

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Data Center Generator Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product

8.6.4.1 Diesel

8.6.4.2 Natural Gas

8.6.4.3 Others

8.6.5 Historic and Forecasted Market Size by Capacity

8.6.5.1 2MW

8.6.6 Historic and Forecasted Market Size by Tier

8.6.6.1 Tier I and II

8.6.6.2 Tier III

8.6.6.3 Tier IV

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Data Center Generator Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product

8.7.4.1 Diesel

8.7.4.2 Natural Gas

8.7.4.3 Others

8.7.5 Historic and Forecasted Market Size by Capacity

8.7.5.1 2MW

8.7.6 Historic and Forecasted Market Size by Tier

8.7.6.1 Tier I and II

8.7.6.2 Tier III

8.7.6.3 Tier IV

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Q1: What would be the forecast period in the Data Center Generator Market research report?

A1: The forecast period in the Data Center Generator Market research report is 2025-2032.

Q2: Who are the key players in the Data Center Generator Market?

A2: Cummins Inc. (US), Caterpillar Inc. (US), Generac Power Systems, Inc. (US), Kohler Co. (US), Briggs & Stratton Corporation (US), Marathon Electric (US), Siemens AG (Germany), Deutz AG (Germany), MTU Onsite Energy (Germany), Aggreko plc (UK), Rolls-Royce Holdings plc (UK), FG Wilson (UK), JCB Power Products Ltd. (UK), Schneider Electric SE (France), Himoinsa S.L. (Spain), Atlas Copco AB (Sweden), Kirloskar Oil Engines Limited (India), Yanmar Holdings Co., Ltd. (Japan), Mitsubishi Corporation (Japan), Doosan Corporation (South Korea), and Other Active Players.

Q3: What are the segments of the Data Center Generator Market?

A3: The Data Center Generator Market is segmented into Product, Capacity, Tier, and region. By Product, the market is categorized into Diesel, Natural Gas, and Others. By Capacity, the market is categorized into 2MW. By Tier, the market is categorized into Tier I and II, Tier III, and Tier IV. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Q4: What is the Data Center Generator Market?

A4: The data center generator market refers to the segment of the power generation industry that provides backup power solutions specifically tailored for data centers. Data centers are facilities that house computer systems and associated components, such as telecommunications and storage systems. These facilities require continuous and reliable power to ensure uninterrupted operation of critical IT infrastructure. Data center generators are designed to provide backup power in the event of utility grid outages or disruptions, ensuring that data center operations remain unaffected by power failures.

Q5: How big is the Data Center Generator Market?

A5: Data Center Generator Market Size Was Valued at USD 16.48 Billion in 2024 and is Projected to Reach USD 36.9 Billion by 2032, Growing at a CAGR of 10.6 % From 2025-2032.

How to Buy a Report from eminsights.jp

On the product page, choose the license you want: Single-User License, Multi-User License or Enterprise License.

If you required report in your native language, then you can click on Translated Report button and fill out the form with report name and language you want, then our team will contact you as soon as possible.

Click the Buy Now button.

You will be redirected to the checkout page. Enter your company details and payment information.

Click Place Order to complete the purchase.

Confirmation: You’ll receive an order confirmation and our team will contact you shortly with your ordered report.

If you have any questions, fill out the contact form below or email us at bizdev@eminsights.net.

Thank you for choosing eminsights.jp!